|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

Primary area of practice |

please specify field of law here:

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

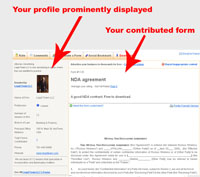

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

|

Advertise your business to thousands for free –

Contribute a form

|

|

Form #1067Asset Purchase Agreement

|

Average user rating: |

Not Yet Rated

|

Rate it |

|

Asset Purchase Agreement - free form to use

|

Need this form customized?

Need this form customized? |

Download This Form

Download This Form

|

Printer Friendly Version

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your

agreement to hold this site, its officers, employees and any contributors to this

site harmless for any damage you might incur from your use of any submissions contained

on this site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice. YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

|

Asset purchase

agreement.

ASSET

PURCHASE AGREEMENT

ASSET PURCHASE AGREEMENT (the "Agreement")

dated as of _________, between _________, a corporation (the

"Purchaser"), and _________, a _________ corporation (the

"Seller").

RECITALS

WHEREAS, the Seller desires to sell and the Purchaser

desires to purchase certain assets, properties, and rights of the Seller;

NOW, THEREFORE, in consideration of the covenants,

agreements, representations, and warranties contained in this Agreement, the

parties hereto hereby agree as follows:

ARTICLE I

PURCHASE

AND SALE OF ASSETS; PURCHASE PRICE; CLOSING

1.1. Purchase and Sale of Assets. Subject to the terms

and conditions of this Agreement, on the Closing Date (as defined herein) the

Seller shall sell, transfer, convey, assign, and deliver to the Purchaser, and

the Purchaser shall purchase, acquire, and accept from the Seller, the

following assets (the "Transferred Assets"):

(a) All of the Seller's right, title, and interest in

and to _________[such rights hereinafter referred to as the "Trade

Name"]; and _________.

1.2. Excluded Assets. Notwithstanding any other

provision of this Agreement, the Seller shall retain and shall not transfer to

Purchaser _________.

1.3. No Assumption of Liabilities or Obligations.

Notwithstanding anything to the contrary in this Agreement, the Purchaser shall

not assume any liabilities or obligations of the Seller and nothing herein

shall be construed as imposing any liability or obligation upon the Purchaser

other than those specifically provided for herein.

1.4. Purchase Price.

(a) Purchase Price. The aggregate consideration for

the Transferred Assets shall be _________[the "Purchase Price"]

payable to the Seller by the Purchaser as described in Section 1.4(b).

(b) Payment. At the Closing, the Purchaser shall pay

and deliver to the Seller _____ Dollars ($_____) in immediately available funds

to the Seller's bank account, as previously instructed to the Purchaser by the

Seller in writing [and the Purchaser's promissory note (the "Note")

in the principal amount of _____ Dollars ($_____) substantially in the form

attached hereto as Exhibit _________.

1.5. Allocation of Purchase Price. The Purchase Price

shall be allocated among the Transferred Assets in the manner set forth in a

schedule to be delivered by the Purchaser to the Seller on or before the

Closing Date. Neither the Purchaser nor the Seller shall, in connection with

any tax return, any refund claim, any litigation or investigation or otherwise,

take any position with respect to the allocation of the Purchase Price which is

inconsistent with the manner of allocation provided in such schedule.

ARTICLE

II

REPRESENTATIONS

AND WARRANTIES OF THE SELLER

Except as otherwise set forth in the schedules

attached to this Agreement by reference to specific sections of this Agreement

(hereinafter collectively referred to as the "Disclosure Schedule"),

the Seller represents and warrants to the Purchaser as set forth below:

2.1. Organization and Good Standing.

(a) Seller. The Seller is a corporation duly

organized, validly existing, and in good standing under the laws of the State

of _________ and is duly qualified to transact business as a foreign

corporation and is in good standing in every jurisdiction in which the conduct

of its business requires it to be so qualified. Certified copies of the

Certificate of Incorporation and the By-Laws of the Seller and all amendments

thereto as presently in effect have been delivered to the Purchaser and are

complete and correct as of the date hereof.

2.2. Authorization, etc. The Seller has full corporate

power and authority to enter into this Agreement, all exhibits and schedules

hereto, and all agreements contemplated herein (this Agreement and all such

exhibits, schedules, and other agreements being collectively referred to herein

as the "Acquisition Documents"), to perform its obligations hereunder

and thereunder, to transfer the Transferred Assets, and to carry out the

transactions contemplated hereby and thereby. The Board of Directors of the

Seller has taken, or will take before the Closing Date, all actions required by

law, its Certificate of Incorporation, its By-Laws or otherwise to authorize

(i) the execution and delivery of this Agreement and the other Acquisition

Documents, and (ii) the performance of its obligations hereunder and

thereunder. This Agreement has been duly executed and delivered by the Seller

and upon the execution and delivery of the remaining Acquisition Documents by a

duly authorized officer of the Seller, the remaining Acquisition Documents will

have been duly executed and delivered by the Seller, and this Agreement is and

such other Acquisition Documents will be, upon due execution and delivery

thereof, the legal, valid, and binding obligations of the Seller enforceable

according to their terms, except (a) as such enforcement may be limited by

bankruptcy, insolvency, reorganization, moratorium general principle, or

similar laws now or hereafter in effect relating to creditors' rights and (b)

that the remedy of specific performance and injunctive and other forms of

equitable relief may be subject to equitable defenses and to the discretion of

the court before which any proceeding may be brought.

2.3. Title to Transferred Assets. The Seller owns and

has good and marketable title to all Transferred Assets, free and clear of all

Liens.

2.4. Title to Properties; Absence of Liens and

Encumbrances. The Seller has good and marketable title to or a valid leasehold

interest in all of its properties and assets, tangible and intangible, free and

clear of all Liens except for (i) Liens set forth in the Schedule 2.4 hereto,

(ii) Liens for current taxes not yet due and payable, and (iii) such other

minor imperfections of title and encumbrances, if any, that do not, in the

aggregate, have a material adverse effect on the business, assets, or financial

condition of the Seller (collectively hereinafter referred to as the

"Permitted Liens"). There is no material asset used or required by

the Seller in the conduct of its business which is not owned by the Seller or

licensed or leased to it pursuant to one of the licenses or leases listed in

Schedule 2.6 hereto.

2.5. Owned Real Property.

(a) Schedule 2.5 hereto contains a complete list of

all real property owned by the Seller (such listed real property hereinafter

referred to as the "Real Property"). The Seller has good and

marketable title to the Real Property owned by it free and clear of any Liens

except for Permitted Liens.

(b) Except for property leased pursuant to leases

listed in Schedule 2.6, the Real Property includes all land, buildings,

structures, and other improvements used by the Seller or necessary to enable

the Seller to conduct its business as it is presently being conducted and as it

has been conducted in the past.

(c) The Seller does not own or hold, is not obligated

under, or party to, any option, right of first refusal, or other contractual

right to acquire any real property or interest therein.

(d) There is no condition of the Real Property, or any

real property leased by the Seller, that would be revealed by an accurate

survey or physical inspection thereof, which would (i) interfere in any respect

with the use, occupancy, or operation thereof as currently used, occupied, and

operated, or (ii) materially reduce the fair market value thereof below the

fair market value such parcel would have had but for such encroachment or other

fact or condition; and no portion of the Real Property or any real property

leased by the Seller encroaches upon any property belonging to any third party.

(e) No portion of the Real Property or any real

property leased by the Seller is located in a special flood hazard area

designated by any state or federal governmental authority.

2.6. Leases. Schedule 2.6 hereto contains a complete

list of (i) each lease pursuant to which the Seller leases, as lessor or

lessee, any real property interest and (ii) each lease pursuant to which the

Seller leases, as lessor or lessee, any type of property in which the

Purchaser's inability to acquire the Seller's rights thereunder would have a

material adverse effect upon the business assets or financial condition of the

Seller and in which the rental payments pursuant to such lease exceed [$_____]

per annum. Each such lease is valid and binding and is in full force and

effect, subject only to exceptions based on bankruptcy, insolvency, or similar

laws of general application, and there are no existing defaults by any party to

any such lease, or any condition, event, or act known to the Seller which, with

notice or lapse of time or both, would constitute such a default. Without

limiting the foregoing, the Seller is not in default under any of such leases,

and the Seller has not received any notice from any person asserting a default

by the Seller under any such lease.

2.7. No Violation. None of (i) the execution and

delivery of this Agreement or any of the other Acquisition Documents by the

Seller, (ii) the performance by the Seller of its obligations hereunder or

thereunder, (iii) the consummation of the transactions contemplated hereby or

thereby after the Closing, will (A) violate any provision of the Certificate of

Incorporation or By-Laws of the Seller; (B) violate, or be in conflict with, or

constitute a default under or breach of, or permit the termination of, or cause

the acceleration of the maturity of, any indenture, mortgage, contract, commitment,

debt or obligation of the Seller, which violation, conflict, default, breach,

termination, or acceleration, either individually or in the aggregate with all

other such violations, conflicts, defaults, breaches, terminations, and

accelerations, would have a material adverse effect on the operations,

business, assets, or financial condition or the Seller or the Transferred

Assets; (C) except for the consent of _________, require the consent of any

other party to or result in the creation or imposition of any Lien upon any

property or assets of the Seller or the Transferred Assets under any indenture,

mortgage contract, commitment, debt or obligation of or to which the Seller is

a party or by which the Seller is bound; (D) violate any statute, law, judgment,

decree, order, regulation, or rule of any court or governmental authority to

which the Seller or the Transferred Assets is subject; or (E) result in the

loss of any material license, privilege, or certificate benefiting the Seller.

2.8. Consents and Approvals of Governmental

Authorities. No consent, approval, or authorization of, or declaration, filing,

or registration with, any governmental or regulatory authority is required to

be made or obtained by the Seller in connection with the execution, delivery,

and performance of this Agreement or any of the other Acquisition Documents by

the Seller.

2.9. Financial Statements.

(a) Delivery. The Seller has delivered to the

Purchaser true and complete copies of audited financial statements including

balance sheets, statements of operations and retained earnings, and statements

of changes in financial position, as of and for the years ended _________[the

"Audited Financials"] as well as its unaudited financial

statements, including balance sheets, statements of operations and retained

earnings, and statements of changes in financial position, as of and for the

_________-month period ending _________[such unaudited financial statements

of the Seller and any notes thereto being hereinafter referred to as the Seller's

"Financial Statements" or, in the case of the Seller's balance sheet,

the "Balance Sheet"].

(b) Accuracy. The Audited Financials and the Financial

Statements are true and correct and fairly present the financial condition of

the Seller as of the respective dates thereof and the results of operations of

the Seller for the periods then ended in accordance with generally accepted

accounting principles ("GAAP") applied on a consistent basis

throughout the periods involved.

2.10 Absence of Certain Changes. Since _________, the

Seller has not:

(i) suffered any material adverse change in its

working capital, condition, financial or otherwise, assets, liabilities,

reserves, business operations, or prospects;

(ii) suffered any damage, destruction, or loss, whether

covered by insurance or not, materially adversely affecting its business

operations, or prospects, assets, or condition, financial or otherwise;

(iii) permitted or allowed any of its property or

assets (real, personal, or mixed, tangible or intangible) to be subjected to

any mortgage, pledge, security interest, conditional sale, or other title

retention agreement, encumbrance, lien, easement, claim, right of way, warrant,

option, or charge of any kind (individually and collectively hereinafter referred

to as a "Lien"), except Permitted Liens;

(iv) created or incurred any liability (fixed,

absolute, accrued, contingent, or otherwise) except for unsecured current

liabilities incurred for other than money borrowed, and liabilities under

contracts entered into in the ordinary course of business and for amounts and

for terms consistent with past practice;

(v) cancelled or compromised any debts, or waived or

permitted to lapse, any material claims or rights, or sold, transferred, or

otherwise disposed of any of its properties or assets (real, personal, or

mixed, tangible or intangible), except in the ordinary course of business and

consistent with past practice;

(vi) transferred or granted any concessions, leases,

licenses, or agreements with respect to or disposed of or permitted to lapse

any rights to the use of any patent, registered trademark, servicemark, trade

name, or copyright material to the business of the Seller (all of which are

listed on Schedule 2.10), or disposed of or disclosed to any person any

material, trade secret, formula, process, or know-how not theretofore a matter

of public knowledge;

(vii) entered into any material commitment or

transaction not in the ordinary course of business and consistent with past

practice or made any capital expenditures or commitments for any additions to

property, plant, or equipment that in the aggregate exceed [$_____];

(viii) paid, loaned, or advanced any amount to, or

sold, purchased, transferred, or leased any properties or assets (real,

personal, or mixed, tangible or intangible) to or from, or entered into any

agreement or arrangement with, any of its officers, directors, or employees, or

any family member of any of its officers, directors, or employees, or any

corporation or other entity controlled by, controlling, or under common control

with it, or any partner, officer, director or employee of any such corporation

or other entity, or any such individual's family members;

(ix) purchased, redeemed, issued, sold, or otherwise

acquired or disposed of, directly or indirectly, any stock, stock options,

warrants, bonds, notes, or other securities, or rights to purchase or convert

into any securities of the Seller;

(x) declared or paid, or set aside funds in

anticipation of, any dividends or other distributions to the Seller or any

holder of any of its securities;

(xi) made any acquisition or disposition of assets

except in the ordinary course of business, consistent with past practice;

(xii) introduced any material change with respect to

the operation of its business, including, without limitation, its method of

accounting;

(xiii) except for sales of inventories in the ordinary

course of business, sold or otherwise disposed of, or entered into or agreed to

enter into any agreement or other arrangement to sell or otherwise dispose of,

any of its assets, properties, or rights or any agreement or other arrangement

which requires the consent of any party to the transfer and assignment of any

such assets, properties, or rights;

(xiv) paid or agreed to pay any bonus or extraordinary

payment to any employee or changed or agreed to change in any material respect

the compensation of any employee; or

(xv) agreed, whether in writing or otherwise, to take

any action described in this Section 2.10.

2.11. Patents, Trademarks, Trade Names. The Seller

owns, is licensed, or otherwise has the full right to use all patents,

trademarks, servicemarks, trade names, and copyrights used in the business of

the Seller as currently conducted. Schedule 2.11 hereto contains a complete and

accurate list of (i) all patents, trademarks, servicemarks, trade names

copyrights, technology, know-how, recipes, and processes used or proposed to be

used by the Seller, all applications therefor, and all licenses and other

agreements relating thereto, and (ii) all agreements relating to technology,

know-how, recipes, or processes that the Seller is licensed or authorized to

use by others or licenses or authorizes others to use. Except as set forth in

any of such licenses or agreements, the Seller has the sole and exclusive right

to use its patents, trademarks, servicemarks, trade names, copyrights,

technology, know-how, recipes, and processes identified in Schedule 2.11

hereto, and no consent of any third party is required for the use thereof by

the Seller upon completion of the transfer of the Transferred Assets. No claims

have been asserted by any person to the use of any such patents, trademarks,

servicemarks, trade names, copyrights, technology, know-how, recipes, or

processes, or challenging or questioning the validity or effectiveness of any

such license or agreement, and the Seller knows of no valid basis for any such

claims. The Seller has not received any notice or is aware of any facts or

alleged facts indicating that the use of such patents, trademarks,

servicemarks, trade names, copyrights, technology, know-how, recipes, or

processes by the Seller infringes on the rights of any other person. No

additional proprietary rights other than those listed on Schedule 2.11 hereto

are necessary or material to the conduct of the business of the Seller.

2.12. Litigation. Schedule 2.12 hereto sets forth all

actions, claims, proceedings, and investigations ("Actions"),

including without limitation Actions for personal injuries, products liability,

or breach of warranty arising from products sold by the Seller, pending or

threatened against the Seller, any properties or rights of the Seller

(including, without limitation, the patents, trademarks, servicemarks, trade

names, copyrights, technology, know-how, recipes, or processes listed in

Schedule 2.11 hereto), or the transactions contemplated by this Agreement or

any other Acquisition Document before any court, arbitrator, or administrative

or governmental body. To the best knowledge of the Seller, no state of facts exists

or has existed that would constitute grounds for the institution of any Action

against the Seller or against any properties or rights of the Seller or the

transactions contemplated by this Agreement or any other Acquisition Document.

The Seller is not subject to any judgment, order, or decree entered in any

lawsuit or proceeding that has materially adversely affected, or that can

reasonably be expected to materially adversely affect, the transactions

contemplated by this Agreement, the Seller, or the Transferred Assets,

including, without limitation, the Seller's business practices and its ability

to acquire any property or conduct business in any way.

2.13. Tax Returns and Payments. All of the tax returns

and reports of the Seller or respecting the operations of the Seller required

by law to be filed on or before the date hereof have been duly and timely filed

and all taxes shown as due thereon have been paid. There are in effect no

waivers of any applicable statute of limitations related to such returns. No

liability for any tax will be imposed upon the Transferred Assets or the Seller

or its assets with respect to any period before the Closing Date for which

there is not an adequate reserve reflected in the balance sheet. The provisions

of this Section 2.13 shall include, without limiting the generality of this

Section, all reports, returns, and payments due under all federal, state, or

local laws or regulations relating to income, sales, use and withholding taxes,

withholding obligations, unemployment insurance, Social Security, workers'

compensation and other obligations of the same or of a similar nature. The

Seller is not subject to any open audit in respect of its taxes, no deficiency

assessment or proposed adjustment for taxes is pending, and the Seller has no

knowledge of any liability, whether or not proposed, for any tax with respect

to any period through the date hereof to be imposed upon any of its properties

or assets for which there is not an adequate reserve reflected in its

respective Balance Sheets.

2.14. Banks. Schedule 2.14 lists all the names and

locations of all banks, trust companies, savings and loan associations, and

other financial institutions at which the Seller maintains accounts or lock

boxes and the corresponding account numbers, if any, relating to the Seller and

the names of all persons authorized to draw on such accounts or who have access

to such boxes.

2.15. Insurance. Schedule 2.15 contains (i) a complete

and accurate description of the Seller's self-insurance practices and items

covered by such self-insurance and (ii) a complete list of all material

policies of fire, liability, workers' compensation and other forms of insurance

owned or held by or for the benefit of the Seller (collectively, the

"Insurance Policies"). The Seller has delivered to the Purchaser true

and complete copies of the Insurance Policies, along with copies of all past

Insurance Policies reasonably available after due and diligent search. The

Seller's tangible real and personal property and assets, whether owned or

leased, are insured by reputable insurance companies licensed to do business in

the state in which such property is located in such amounts customarily carried

by comparable businesses, except to the extent that any failures to insure

would not, in the event of a loss, have a material adverse effect upon the

business of Seller. All such Insurance Policies are and will remain in full

force and effect through the Closing Date and, to the best knowledge of the

Seller, there is no notice of or basis for any modification, suspension,

termination, or cancellation of any Insurance Policy.

2.16. Contracts and Commitments.

(a) Schedule 2.16 hereto contains a complete list of

each contract and commitment of the Seller that is material to the operations,

assets, business or financial condition of the Seller or that by its terms can

reasonably be expected to require future payment by or to the Seller of

[$_____] or more, including but not limited to the following:

(i) all employment contracts and commitments between

the Seller and its employees, other than those terminable by the Seller at will

and without payment or penalty;

(ii) all collective bargaining agreements and union

contracts to which the Seller is a party;

(iii) all contracts or commitments, written or oral,

with distributors, brokers, manufacturer's representatives, sales

representatives, service or warranty representatives, customers, and other

persons, firms, or corporations engaged in the sale or distribution of the

Seller's products;

(iv) all purchase orders issued by the Seller in

excess of [$_____], all sales orders received by the Seller in excess of

[$_____] and all purchase or sales orders that call for delivery or performance

on a date more than one year from the date of this Agreement;

(v) all contracts and arrangements between the Seller

or any person or entity that controls, is controlled by, or is under common

control with, the Seller or any family member of any such person (such entity

or person, being hereinafter referred to as an "Affiliate");

(vi) all contracts and arrangements, written or oral,

under which the Seller is either a bailor or bailee including without

limitation contracts for the bailment of vehicles;

(vii) all agreements pursuant to which the Seller

acquired the Trade Name or a substantial portion of its assets; and

(viii) all other contracts and commitments of the

Seller (excluding leases for the purpose of this Section 2.16(a)) and

instruments reflecting obligations for borrowed money or for other indebtedness

or guarantees thereof.

(b) At the Purchaser's request, the Seller shall

deliver or cause to be delivered to the Purchaser full and complete copies of

the documents identified above and all such other agreements and instruments as

the Purchaser may reasonably request.

(c) The Seller is not a party to any written agreement

that would restrict it from carrying on any line of business anywhere in the

world.

(d) Each of the contracts listed on Schedule 2.16 is

valid and binding, and each of the contracts binding on the Seller (whether or

not listed on Schedule 2.16) has been entered into in the ordinary course of

business, and none of the contracts binding on the Seller contains terms or

conditions that are materially adverse to the Seller. Neither the Seller nor

any other party hereto is in default under or in breach or violation of, and

neither the Seller nor any other party hereto has received notice of any

asserted claim of default by any other party under, or a breach or violation

of, any of the contracts, agreements, and commitments described in this Section

2.16, including without limitation, any licensing or usage agreements with

respect to the technology that the Seller now uses or currently intends and

plans to use.

2.17. Distributors and Customers. To the Seller's best

knowledge, it enjoys good working relationships under all of its distributor,

sales representative, and similar agreements necessary to the normal operation

of its business. The Seller has no knowledge or basis for knowledge that any

customer or group of related customers (i.e., any customers who are directly or

indirectly through one or more intermediaries under common control), who, for

the fiscal year ended _________ and during each of the two preceding fiscal

years accounted for more than [$_____] in aggregate volume of gross sales of

the Seller, has terminated or expects to terminate a material portion of its

normal business with the Seller.

2.18. Fringe Benefit Plans.

(a) List of Plans. Schedule 2.18 contains a true and

complete list and summary description of, and the Seller has delivered to the

Purchaser true and complete copies of, each pension, retirement,

profit-sharing, stock purchase, stock option, vacation, deferred compensation,

bonus or other incentive plan, or other employee benefit program, arrangement,

agreement, or understanding, or medical, vision, dental, or other health plan,

or life insurance or disability plan, or any other employee benefit plans,

including, without limitation, any "employee benefit plan" as defined

in section 3(3) of the Employee Retirement Income Security Act of 1974, as

amended ("ERISA"), whether formal or informal, written or oral, to

which the Seller contributes, or is a party, or is bound, or under which it may

have liability, and under which employees or former employees of the Seller (or

their beneficiaries) are eligible to participate or derive a benefit. Each

employee benefit plan which is a "group health plan" as such term is

defined in section 162(i)(2) of the Internal Revenue Code of 1986, as amended

(the "Code"), satisfies the applicable requirements of section 4980B

of the Code. Except as described on Schedule 2.18, the Seller does not have the

intention or commitment, whether legally binding or not, to create any

additional plan, practice, or agreement, or to modify or change any existing

plan, practice, or agreement that would affect any employee or terminated

employee of the Seller, and benefits under all employee benefit plans are as

represented and have not been and will not be increased after the date on which

documents have been provided.

(b)

Representations with Respect to Plans. Except as disclosed on Schedule 2.18,

the Seller does not sponsor, maintain, or contribute to any employee benefit

plans within the meaning of section 3(3) of ERISA, which are subject to Title I

of ERISA (the "ERISA Plans"). Each pension plan within the meaning of

section 3(2) of ERISA

("Pension Plan") is identified on Schedule

2.18. The following representations are made with regard to the ERISA Plans or

the Pension Plans, if so limited:

(i) the Seller does not contribute to, or have an

obligation to contribute to, or has at any time contributed to or had an

obligation to contribute to, sponsor, or maintain, or at any time has sponsored

or maintained, a multiemployer plan within the meaning of section 3(37) of

ERISA and the Seller has not incurred any withdrawal liability, or suffered a

"complete withdrawal" or a "partial withdrawal" with

respect to a multiemployer plan;

(ii) the Pension Plans are qualified plans, have

remained qualified under the Code since inception and have been determined by

the Internal Revenue Service ("IRS") to be so qualified, and the IRS

has taken no action to revoke such determination or qualification;

(iii) the Seller has, in all material respects,

performed all obligations, whether arising by operation of law, contract, or

past custom, required to be performed under or in connection with the ERISA

Plans, and the Seller does not have any knowledge of any default or violation

by any other party with respect to the ERISA Plans;

(iv) the Seller has complied in all material respects

with ERISA, and, where applicable, the Code, regarding the ERISA Plans;

(v) all reports and disclosures relating to the ERISA

Plans required to be filed with or furnished to governmental agencies, plan

participants, or plan beneficiaries have been or will be filed or furnished in

accordance with applicable law in a timely manner;

(vi) there are no Actions pending (other than routine

claims for benefits) or, to the knowledge of the Seller threatened, against any

ERISA Plan or against the assets funding any ERISA Plan;

(vii) full payment has been or will be made, in

accordance with section 404(a)(6) of the Code, of all amounts which the Seller

is required to pay under the terms of the Pension Plans as contributions to the

Pension Plans as of the last day of the most recent plan year of the Pension

Plans ended before the date of this Agreement, and neither the Pension Plans

nor the trusts established thereunder have incurred any "accumulated

funding deficiency" (as defined in section 302 of ERISA and section 412 of

the Code), whether or not waived, as of the last day of the most recent plan

year of the Pension Plans ended before the date of this Agreement;

(viii) the Seller maintains adequate accruals on its

books to reflect accrued contributions to each of the Pension Plans for the

current plan year and to reflect accrued medical and dental claims incurred,

but not yet paid, under the terms of any ERISA Plan which is a welfare plan

within the meaning of section 3(1) of ERISA (a "Welfare Plan");

(ix) no transaction has occurred with respect to the

Pension Plans or the assets thereof which could result in the imposition on the

Seller or the administrators or trustees under the Pension Plans, either

directly or indirectly, of taxes or penalties imposed under section 4975 of the

Code or section 502(i) of ERISA;

(x) with respect to the Pension Plans, regardless of

whether such plans are subject to Title IV of ERISA, no termination or

reportable event, as defined in section 4043(b) of ERISA has occurred or is

anticipated to occur;

(xi) as of [_________] the fair market value of assets

of each Pension Plan which is a "defined benefit plan" as defined in

section 3(35) of ERISA ("Defined Benefit Plan") equals or exceeds the

aggregate present value of the accrued benefits thereunder of all participants,

computed on a "plan termination basis," based upon actuarial

assumptions which are reasonable in the aggregate;

(xii) other than applications for determination, no

action is pending with respect to the Pension Plans before the IRS, the

Department of Labor, the Pension Benefit Guaranty Corporation ("PBGC")

or before any state or local governmental agency;

(xiii) no act or omission constituting a breach of

fiduciary duties has occurred with respect to the ERISA Plans or the assets

thereof which could subject the Seller or the Purchaser, either directly or

indirectly, to any liability;

(xiv) no liability under Title IV of ERISA has been

incurred by the Seller since the effective date of ERISA, other than liability

for premiums due to the PBGC which has been satisfied in full and the Seller

does not know of any facts or circumstances which might give rise to any

liability of the Seller under Title IV of ERISA which could reasonably be

anticipated to result in any claims being made against the Purchaser or the

Seller by the PBGC;

(xv) the PBGC has not instituted any proceedings to

terminate any of the Pension Plans; and

(xvi) each

Welfare Plan is intended to meet currently applicable requirements for

tax-favored treatment under Subchapter B of Chapter 1 of the Code, is in

compliance with such requirements, and if applicable, with the

requirements of sections 419 and 419A of the Code, and

there is no disqualified benefit (as such term is defined in section 4976(a) of

the Code) which would subject the Seller or the Purchaser to a tax under

section 4976.

(c) Plan Documents. The Seller has delivered to the

Purchaser and its counsel true and complete copies of (i) all documents

governing the ERISA Plans, including all amendments thereto which will become

effective at a later date, (ii) all agreements and arrangements listed on

Schedule 2.18, (iii) the latest IRS determination letter obtained with respect

to each of the Pension Plans, (iv) Form 5500 for the most recent completed plan

year for each of the ERISA Plans, together with all schedules forming a part

thereof, (v) the most recent actuarial valuation for any Defined Benefit Plan,

(vi) any form, other than Form 5500, required to be filed for the most recently

completed plan year for any Defined Benefit Plan with any governmental agency,

(vii) all summary plan descriptions relating to the ERISA Plans, (viii) the

annuity contracts funding obligations of any Defined Benefit Plan, and (ix) all

employment manuals.

2.19. Labor Relations. No employee of the Seller is

represented by a labor union, and no petition has been filed or proceedings

instituted by any employee or group of employees with any labor relations board

seeking recognition of a bargaining representative. There are no matters

pending before the National Labor Relations Board or any similar state or local

labor agency, and the Seller is neither engaged in nor subject to any penalties

or enforcement action in respect of any unfair labor practices, and the Seller

believes that it enjoys good labor relations. There are no controversies or

disputes pending between the Seller and any of its employees, except for such

controversies and disputes as do not and will not, individually or in the

aggregate, have a material adverse effect on its business, operations, assets,

prospects, or condition, financial or otherwise.

2.20. Environmental Matters.

(a) For purposes of this Section 2.20, the property of

the Seller shall mean such property whether now or in the past owned or leased

by it. Additionally, for purposes of this Section 2.20, "Hazardous

Substance" means (i) a "hazardous substance" as defined in 42

USC §9601(14), as amended from time to time, and all rules, regulations, and

orders promulgated thereunder as in effect from time to time, (ii)

"hazardous waste" as defined in 42 USC §6903(5), as amended from time

to time, and all rules, regulations, and orders promulgated thereunder as in

effect from time to time, (iii) if not included in (i) or (ii) above,

"hazardous waste constituents" as defined in 40 CFR § 260.10,

specifically including Appendix VII and VIII of Subpart D of 40 CFR § 261, as

amended from time to time, and all rules, regulations, and orders promulgated

thereunder as in effect from time to time, and (iv) "source,"

"special nuclear," or "by-product material" as defined in

42 USC §3011, et seq., as amended from time to time, and all rules,

regulations, and orders promulgated thereunder as in effect from time to time.

Further, "Requirements of Law" shall mean all applicable federal,

state, local, or foreign laws, statutes, ordinances, rules, regulations, or

court or administrative orders or processes, or arbitrator's orders or

processes.

(b) The Seller is and has been in compliance with all

Requirements of Law relating to Hazardous Substances and applicable to any of

its properties. Without limiting the foregoing, (i) neither the operations of

the Seller nor the development, manufacture, or sale of the processes,

technology, results, or products of the Seller violate or have violated any

Requirements of Law relating to air, soil, water, or noise pollution, or the

production, storage, processing, utilization, labeling, transportation,

disposal, emission, or other disposition of Hazardous Substances, and (ii) the

Seller, or any current or former owner, occupant or operator of any property at

any time owned, leased, or operated by the Seller, or any portion thereof, has

never utilized any such property or any portion thereof in violation of any

environmental Requirements of Law.

(c) No discharge, release, spillage, uncontrolled

loss, seepage, or filtration of any Hazardous Substance or any fuel, gasoline,

or other petroleum product or by-product has occurred at, upon, or under any

property at any time owned, leased, or operated by the Seller in an amount that

violates any Requirements of Law.

(d) The Seller does not utilize, store, dispose of,

treat, generate, process, transport, release, or own any Hazardous Substance,

nor has the Seller ever done so.

(e) The Seller has in a timely manner obtained all

Licenses and filed all reports required to be filed under or pursuant to any

applicable environmental Requirements of Law.

(f) No property at any time owned, leased, or operated

by the Seller now contains, or, to the knowledge of the Seller, in the past has

contained, any underground or aboveground tanks for the storage of any

Hazardous Substance or fuel oil, gasoline, or any other petroleum product or

by-product.

(g) The

Seller has not received any notice of writs, injunctions, decrees, orders, or

judgments outstanding, or suits, claims, actions, proceedings, or investigations

instituted or threatened under any environmental Requirements

of Law applicable to any of the properties at any time

owned, leased, or operated by the Seller, including but not limited to any

notice from any governmental authority or private or public entity advising the

Seller that it is or is potentially responsible for response costs under the

Comprehensive Environmental Response, Compensation and Liability Act

("CERCLA"), as amended, with respect to a release or threatened

release of Hazardous Substances.

(h) The Seller has not received notice of any

violation of any environmental, zoning, worker safety, or land use Requirements

of Law relating to the operation of the Seller or to any of the processes used

or followed, results obtained, or products developed, made, or sold by the

Seller including, without limitation, under CERCLA, the Toxic Substances

Control Act of 1976, as amended, the Resource Conservation and Recovery Act of

1976, as amended, the Clean Air Act, as amended, the Federal Water Pollution

Control Act, as amended, or the Occupational Safety and Health Act of 1970, as

amended.

2.21. Compliance with Laws. The Seller is not in

violation of, has not been charged with any violation of, or, to the best of

its knowledge, is not under any investigation with respect to any charge

concerning any violation of any Requirements of Law, in which such violation

either singly or in the aggregate with other violations would have a material

adverse effect upon the operations, assets, business or financial condition of

the Seller. The Seller is not in default with respect to any order, writ,

injunction, or decree of any court, agency, or instrumentality. Without

limiting the generality of the foregoing, the Seller is in compliance with (A)

all Requirements of Law promulgated by the Occupational Safety and Health

Administration, and (B) all environmental Requirements of Law.

2.22. Licenses, Permits, and Authorizations. The

Seller has all approvals, authorizations, consents, licenses, franchises,

orders, and other permits (collectively, "Licenses") of (i) any

governmental or regulatory agency, whether federal, state, local or foreign,

and (ii) all trade or industry associations, required to permit it to carry on

its business as presently conducted, all of which are in full force and effect.

Schedule 2.22 hereto sets forth all such Licenses required for the operation of

the business of the Seller.

2.23. Inventory. The inventories of the Seller reflected

on its Balance Sheet are in good and merchantable condition and are suitable

and usable or saleable in the ordinary course of business for the purposes

intended, net of the reserves stated on the Seller's Balance Sheet. The value

of the inventory set forth on the Seller's Balance Sheet (net of such reserves)

was established in accordance with GAAP and with the Seller's inventory

valuation and write-down policies so that the net value thereof stated on such

Balance Sheet shall have been determined. The Seller has reasonable inventories

to conduct its business consistent with past practices. There has been no

material adverse change since _________ in the amount or condition of the

inventories or the reserves with respect thereto.

2.24. Accounts Receivable. All accounts receivable of

the Seller represent bona fide and valid claims arising in connection with

sales of products by the Seller and, except to the extent of the reserves

stated on the Seller's Balance Sheet, the Seller's accounts receivable are

collectible and are not subject to any counterclaim or setoff. There has been

no material adverse change since _________ in the amount, validity, or

collectibility of the accounts receivable of the Seller from that stated on the

Seller's Balance Sheet.

2.25. Property of Others. No shortage exists in (i)

any inventory of raw material, work in progress, or finished goods owned by

customers or suppliers of the Seller and stored upon its premises or otherwise,

or (ii) any other item of personal property owned by another for which the

Seller is accountable to another. Without limiting the foregoing, all items of

personal property for which the Seller is accountable under any bailment

agreement, consignment contract, loan program, or otherwise are fully accounted

for with no shortages or missing or lost items, are in workable, usable, and

saleable condition, and have suffered no damage or deterioration.

2.26. Disclosure of Confidential Information. The

Seller has fully disclosed, or will disclose to the Purchaser, on or before the

Closing Date, all processes, inventions, recipes, methods, formulas, plans,

drawings, customer lists, secret information, recipes, and know-how (whether

secret or not) known to them or in their possession and usable by the Seller in

connection with its business as now conducted or proposed to be conducted.

2.27.

Condition of tangible Assets. All of the facilities of the Seller and its

equipment and other tangible assets are in good condition and repair (ordinary

wear and tear excepted) and workable, usable, and adequate for the uses to

which they have been put by the Seller in the ordinary course of business, and

none of such facilities and none of

such equipment or other tangible assets (exclusive of

obsolete items no longer used in the Seller's business) is in need of other

than routine maintenance or repair. The Seller has not received any notice of

any violations of any Requirements of Law with respect to the Seller's

properties or operations that have not been cured.

2.28. Product and Service Warranties. Schedule 2.28

hereto contains a true and complete description of all warranties to third

parties with respect to all products manufactured, assembled, or sold by the

Seller that have been in effect at any time over the last five years, except

for warranties imposed by law.

2.29. Absence of Undisclosed Liabilities. The Seller

does not have any material debt, liability, or obligation of any nature,

whether known or unknown, or fixed, absolute, accrued, contingent, or

otherwise, except those which (i) are accrued or reserved against in the

Audited Financials or the Financial Statements, (ii) have been specifically

disclosed in the Disclosure Schedule hereto by reference to the specific

section of this Agreement to which such disclosure relates, or (iii) have been

incurred since _________ in the ordinary course of business in amounts and for

terms consistent, individually and in the aggregate, with the Seller's past

practice.

2.30. Disclosure. No representation or warranty by the

Seller in this Agreement or any of the other Acquisition Documents (including,

without limitation, the Disclosure Schedule), contains or will contain any

untrue statement of a material fact or omits or will omit to state any material

fact necessary to make the statements herein or therein not misleading. There

is no fact known to the Seller that materially adversely affects, or that might

in the future materially adversely affect, the operations, business, assets,

properties, or condition, financial or otherwise, of the Seller that has not

been set forth in this Agreement or the Disclosure Schedule.

2.31. Brokerage. No broker or finder has acted

directly or indirectly for the Seller or any of their Affiliates in connection

with this Agreement or the transactions contemplated hereby, and no broker or

finder is entitled to any brokerage or finder's fee or other commission in

respect thereof based in any way on the actions or statements of, or

agreements, arrangements, or understandings made with the Seller or any of its

Affiliates.

ARTICLE

III

REPRESENTATIONS

AND WARRANTIES OF THE PURCHASER

The Purchaser hereby represents and warrants to the

Seller as set forth below:

3.1. Corporate Organization, etc. The Purchaser is on

the date hereof, and will be on the Closing Date, a corporation duly organized,

validly existing and in good standing under the laws of the State of _________.

3.2. Authorization, etc. The Purchaser has full

corporate power and authority to enter into this Agreement and the other

Acquisition Documents to which it is or will be a party, to perform its

obligations hereunder and thereunder, and to carry out the transactions

contemplated hereby and thereby. The Board of Directors of the Purchaser has

taken, or will take before the Closing Date, all actions required by law, its

Certificate of Incorporation, its By-Laws or otherwise to authorize (i) the

execution and delivery of this Agreement and the other Acquisition Documents

and (ii) the performance of its obligations hereunder and thereunder. This

Agreement has been duly executed and delivered by the Purchaser and, upon the

execution and delivery of the remaining Acquisition Documents by a duly

authorized officer of the Purchaser, the remaining Acquisition Documents will

have been duly executed and delivered by the Purchaser, and this Agreement is,

and such other Acquisition Documents will be, upon due execution and delivery

thereof, the legal, valid, and binding obligations of the Purchaser,

enforceable according to their terms (A) as such enforceability may be limited

by bankruptcy, insolvency, reorganization, moratorium, or similar laws now or

hereafter in effect relating to creditors' rights, and (B) that the remedy of

specific enforcement and injunctive and other forms of equitable relief may be

subject to equitable defenses and to the discretion of the court before which

any proceeding therefor may be brought.

3.3. No

Violation. None of (i) the execution and delivery of this Agreement or any

other Acquisition Document by the Purchaser, (ii) the performance by the

Purchaser of its obligations hereunder or thereunder, or (iii) the consummation

of the transactions contemplated hereby or thereby will (A) violate any

provision of the Certificate of

Incorporation or By-Laws of the Purchaser, (B)

violate, or be in conflict with, or permit the termination of, or constitute a

default under or breach of, or cause the acceleration of the maturity of, any

contract, debt, or other obligation of the Purchaser, which violation,

conflict, default, breach, termination or acceleration, either individually or

in the aggregate with all other such violations, conflicts, defaults, breaches,

terminations and accelerations, would have a material adverse effect on the

business, assets or financial condition of the Purchaser, (C) except as set

forth in Schedule 3.3 hereof, require the consent of any other party to, or

result in the creation or imposition of any Lien upon any property or assets of

the Purchaser under any agreement or commitment to which the Purchaser is a

party or by which the Purchaser is bound, or (D) to the best knowledge and

belief of the Purchaser, violate any statute or law or any judgment, decree,

order, regulation, or rule of any court or governmental authority to which the

Purchaser is subject.

3.4. Litigation. There is no action pending or, to the

best knowledge and belief of the Purchaser, threatened against the Purchaser,

or any properties or rights of the Purchaser, that questions or challenges the

validity of this Agreement or any of the other Acquisition Documents, nor any

action taken or to be taken by the Purchaser pursuant hereto or thereto or in

connection with the transactions contemplated hereby or thereby and the

Purchaser does not know of any such action, proceeding, or investigation that

may be asserted.

3.5. Disclosure. No representation or warranty by the

Purchaser in this Agreement contains or will contain any untrue statement of a

material fact or omits or will omit to state any material fact necessary to

make the statements herein not misleading.

3.6. Brokerage. No broker or finder has acted directly

or indirectly for the Purchaser or its Affiliates in connection with this

Agreement or the transactions contemplated hereby, and no broker or finder is

entitled to any brokerage or finder's fee or other commission in respect

thereof based in any way on the actions or statements of, or the agreements,

arrangements, or understandings made with the Purchaser or its Affiliates.

ARTICLE

IV

OBLIGATIONS

OF THE PARTIES

The Seller hereby covenants and agrees with the

Purchaser and the Purchaser hereby covenants and agrees with the Seller that:

4.1. Reasonable Access. The Seller shall or shall

cause the Seller to afford the Purchaser and its counsel, accountants, and

other authorized representatives reasonable access during normal business hours

to its plants, properties, books and records that the Purchaser and its

advisors may have the opportunity to make such reasonable investigations as

they shall desire to make of the affairs of the Seller; provided, however,

except for _________, the Purchaser shall not contact employees of the Seller

to discuss the transactions contemplated by this Agreement. The Seller shall

furnish to the Purchaser any additional financial and operating data and other

information as the Purchaser and its counsel, accountants, and other authorized

representatives shall from time to time reasonably request. The Purchaser

shall, upon reasonable request, provide the Seller, its counsel, accountants

and other authorized representatives with such information concerning the

Purchaser as may be reasonably necessary for the Seller to verify the

Purchaser's performance of and compliance with its representations, warranties,

and covenants herein contained.

4.2. Conduct Before Closing Date. Before the Closing

Date, except as otherwise contemplated by this Agreement or as permitted by the

prior written consent of the Purchaser, but without making any commitment on

the Purchaser's behalf, the Seller shall:

(a) conduct its business and operations only in the

ordinary course, including, without limitation, maintaining inventories of

finished goods, taken as a whole, at levels consistent with past practice;

(b) maintain all of its properties and assets in good

condition, working order, and repair (except for ordinary wear and tear);

(c) perform its obligations under all agreements

binding upon it and maintain all of its Licenses in good standing;

(d) continue in effect the Insurance Policies (or

similar coverage) referred to in Section 2.14 hereof;

(e) keep available the services of its current

officers and employees;

(f) maintain and preserve the good will of the

suppliers, customers, and others having business relations with it;

(g) before the Closing Date, consult with the

Purchaser from time to time with respect to any actual or proposed material

conduct of its business; and

(h) continue all capital expenditure programs in

progress before the Closing Date.

4.3. Prohibited Transactions Before Closing Date.

Before the Closing Date, except as otherwise

contemplated by this Agreement or permitted by the prior written consent of the

Purchaser, the Seller shall not:

(a) become a party to any agreement which, if it had

existed on the date hereof, would have come within the scope of the Disclosure

Schedule pursuant to Section 2.16 hereof;

(b) do any of the things listed in Section 2.10

hereof;

(c) enter into any compromise or settlement of any

litigation, proceeding or governmental investigation relating to its properties

or business; or

(d) directly or indirectly, in any way, contact,

initiate, enter into, or conduct any discussions or negotiations, or enter into

any agreements, whether written or oral, with any person or entity with respect

to the sale of any of the Seller's assets or shares of capital stock or a

merger or consolidation of the Seller with any other entity or a sale of any of

the other Transferred Assets.

4.4. Further Assurances. Before and after the Closing,

each party hereto shall execute and deliver such instruments and take such

other actions as any other party may reasonably request for the purpose of

carrying out the intent of this Agreement and the other Acquisition Documents.

Each party hereto shall use its best efforts to cause the transactions contemplated

by this Agreement and the other Acquisition Documents to be consummated, and,

without limiting the generality of the foregoing, to obtain all consents and

authorizations of government agencies and third parties and to make all filings

with and give all notices to government agencies and third parties that may be

necessary or reasonably required to effect the transactions contemplated by

this Agreement and the other Acquisition Documents. The Seller shall give

prompt notice to the Purchaser, after receipt thereof by the Seller, of (i) any

notice of, or other communication relating to, any default or event that, with

notice or lapse of time or both, would become a default under any indenture,

instrument, or agreement material to the Seller, to which the Seller is a party

or by which the Seller is bound, and (ii) any notice or other communication

from any third party alleging that the consent of such third party is or may be

required in connection with the transactions contemplated by this Agreement and

the other Acquisition Documents. Each corporate party shall deliver to the

other, by _________, appropriate evidence of the approval of its Board of

Directors and stockholders (if required by law) of this Agreement, the other

Acquisition Documents and the transactions contemplated hereby and thereby.

4.5. Confidentiality. Before and after the Closing,

each party to this Agreement shall, and shall cause its officers, accountants,

counsel, and other authorized representatives and affiliated parties, to hold

in strict confidence and not use or disclose to any other party without the

prior written consent of the other party, all information obtained from the

other parties in connection with the transactions contemplated hereby, except

such information may be used or disclosed (i) when required by any regulatory

authorities or governmental agencies, (ii) if required by court order or decree

or applicable law, (iii) if it is publicly available other than as a result of

a breach of this Agreement, (iv) if it is otherwise contemplated herein, or (v)

by the Purchaser from and after the Closing to the extent related to the Seller

or the Transferred Assets.

ARTICLE

V

CONDITIONS

TO PURCHASER'S OBLIGATIONS

The obligation of the Purchaser under this Agreement

to consummate the Closing on the Closing Date shall be subject to the

satisfaction, on or before the Closing Date, of each of the following

conditions:

5.1.

Representations and Warranties True. The representations and warranties of the

Seller contained herein, in the other Acquisition Documents (including, without

limitation, all schedules and exhibits hereto and thereto) and in

all certificates and documents delivered by the Seller

shall be true and accurate as of the Closing Date, except for changes permitted

or contemplated by this Agreement.

5.2. No Material Changes.

(a) No portion of the assets material to the operation

of the business of the Seller shall, after _________ and before the Closing

Date, be damaged, destroyed, or taken by condemnation, whether or not covered

by any Insurance Policy.

(b) After _________, and before the Closing Date, the

Seller shall have suffered or become bound by changes of any kind or nature

that either individually or in the aggregate have a material adverse effect on

its ability to continue its business operations.

(c) No material adverse change in the business,

assets, or financial condition of the Seller shall have occurred after

_________ and be continuing.

5.3. Performance. The Seller shall have performed and

complied in all material respects with all agreements, obligations, and

conditions required by this Agreement or the other Acquisition Documents to be

performed or complied with by them on or before the Closing Date, including,

without limitation, those set forth in Article _________.

5.4. Consents. All filings with and consents from

government agencies and third parties required to consummate the transactions

contemplated hereby and by the other Acquisition Documents shall have been made

or obtained (including without limitation the consents of the lessors under the

leases referred to in Section 2.6 hereof), except to the extent that making any

such filing or obtaining any such consent has been waived in writing by the

Purchaser or the failure to obtain any such consent or make any such filing

would not have a material adverse effect on the assets, properties, operations,

business, or condition, financial or otherwise, of the Seller or the

transactions contemplated hereby or by the other Acquisition Documents.

5.5. Closing Documents. The Seller shall have

delivered, or caused to be delivered to the Purchaser, the documents and

instruments described below.

(a) The opinion of _________, counsel for the Seller,

in form and substance reasonably satisfactory to the Purchaser and its counsel

and containing such assumptions and limitations as are customary or reasonable

for opinion letters normally provided in similar transactions, covering at

least the following:

(i) the Seller is a corporation validly existing and

in good standing under the laws of its state of incorporation;

(ii) the execution, delivery, and performance of this

Agreement, the other Acquisition Documents to which the Seller is a party, and

the other instruments or documents required to be executed by the Seller in

connection herewith and therewith have been authorized by all necessary

corporate and other actions of the Seller and have been duly executed and

delivered by the Seller and constitute legal, valid, and binding obligations of

such parties enforceable in accordance with their terms to the extent the

Purchaser should be able to realize the practical benefits thereof, except as

such enforceability may be limited by bankruptcy, reorganization, insolvency,

moratorium, or similar laws affecting the enforcement of creditor's rights and

except as the availability of suitable remedies may be subject to judicial

discretion;

(iii) the consummation of the transactions

contemplated by this Agreement, the other Acquisition Documents to which the

Seller is a party, and all other instruments or documents required to be

executed by the Seller in connection herewith and therewith will not violate or

result in a breach of or constitute a default under the Articles of

Incorporation, By-Laws, or other organizational agreements of the Seller; and

(iv) except for such actions and proceedings as are

disclosed to the Purchaser in writing, Seller's counsel does not know of any

limitation, governmental investigation, actions, or suits, pending or

threatened, against or relating to the transactions contemplated by this

Agreement or any other Acquisition Document to which Seller is a party.

(b) Certified copies of the resolutions adopted by the

Boards of Directors of the Seller, or by appropriate committees thereof,

authorizing this Agreement and the other Acquisition Documents and the

transactions contemplated hereby and thereby.

(c) A

certificate of amendment to the Certificate of Incorporation of the Seller,

duly authorized and executed and in form and substance suitable for immediate

filing by the Purchaser with the Secretary of State of the State of

_________, changing the Seller's name to one which

does not include the Trade Name, any variation thereof, or any other word which

could be reasonably confused therewith.

(d) Certificates of the Secretary of State of each of

the states in which the Seller is qualified to transact business as a foreign corporation,

dated no earlier than _________, respecting the good standing of the Seller in

each such jurisdiction.

(e) By-Laws of the Seller certified as of the Closing

Date by a secretary or assistant secretary of the Seller.

(f) Such other documents, instruments, or certificates

as shall be reasonably requested by the Purchaser or its counsel.

5.6. Environmental Report. If the Purchaser shall

choose at its expense to retain an environmental consulting firm to render an

environmental audit report respecting the Seller and such firm renders a report

that details violations of federal, state, or local environmental Requirements

of Law, the Seller shall have cured or shall have caused the Seller to cure

such violations or the Purchaser shall have waived such compliance with this

Section 5.6; provided, however, that the Seller shall not be obligated to cure

any such violation.

5.7. Certificates of the Seller. The Seller shall have

furnished such certificates of its officers and others as may reasonably be

required by the Purchaser to evidence compliance with the conditions set forth

in this Article 5.

5.8. Tradename Assignment. The Purchaser and the

Seller shall have entered into an Assignment of the Trade Name substantially in