|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

Primary area of practice |

please specify field of law here:

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

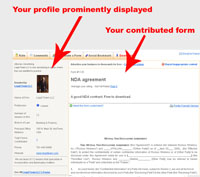

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

|

Advertise your business to thousands for free –

Contribute a form

|

|

Form #1178Rental agreement article - for taxes and operating expenses

|

Average user rating: |

Not Yet Rated

|

Rate it |

|

A rental agreement addendum that has to do with taxes and operating expenses - free to download and use!

|

Need this form customized?

Need this form customized? |

Download This Form

Download This Form

|

Printer Friendly Version

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your

agreement to hold this site, its officers, employees and any contributors to this

site harmless for any damage you might incur from your use of any submissions contained

on this site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice. YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

|

For taxes and operating

expenses.

(a). The following definitions apply in this article:

1. The expression "operating costs" means

each and every item of cost and expense of whatever variety or description paid

or incurred for maintenance or operation of the land and building of which the

demised premises form a part, including but not by way of limitation, real

estate taxes levied against the land and building (which term "taxes"

includes assessments for betterments and improvements); water rates; sewer

rents; wages; employee fringe benefits of every kind (i.e., paid vacations, hospitalization,

disability, etc.) required by law or under union contract to be paid to

employees; social security payments and unemployment insurance; payrolls and

other taxes applicable to wages; cleaning, washing and rubbish removal;

uniforms; elevator maintenance; air-conditioning maintenance; heating;

insurance. There shall be excluded, however, costs of painting and decorating

for any occupant's space; administrative wages and salaries; management fees

and renting commissions; franchise taxes; income taxes. There shall also be

excluded the cost of any item of replacement that by sound accounting practice

should be capitalized on the books of the landlord, except that where such

replacement results in the reduction of operating costs the cost of the

replacement may be amortized over a reasonable period of time according to

sound accounting practice and so charged to operating costs but not in an

amount in any year greater than the actual cost saving in that year. Where the

maintenance is performed by a general contractor, the contract price of the

general contractor shall govern the cost of the item performed by such

contractor, but if the latter is related to, or is associated or affiliated

with the landlord, then such contractor's costs shall be used only to the extent

that they do not exceed what would be charged by a reasonably prudent

independent contractor in a comparable building.

2. "Base year" means the real property tax

year, beginning _________[year], and ending _________[year].

3. "Subsequent year" means each real

property tax year following the base year.

4. "Base year costs" means the operating

costs for the base year adjusted, however; to reflect any projections that are

needed to compensate for vacancies in the building during the base year, and

adjusted further by adding to such costs the amounts that would have been

incurred by landlord for servicing a particular occupant's premises where that

occupant furnishes services in whole or in part—the amounts so to be added to

be gauged by that which would be charged by a reasonably prudent independent

contractor in a comparable building.

(b). Tenant shall pay as additional rental _____%

("area ratio") of the amount by which the operating costs for any

subsequent year occurring during the term exceed the base year costs. If tenant

shall have paid any such increase for any subsequent year and thereafter there

is a reduction in operating costs in a subsequent year occurring during the

term so that such costs come below the base year costs, then tenant, if not in default

in a substantial obligation hereunder, shall be entitled to a payment equal to

the area ratio applied to the reduction below the base year costs for the

particular year concerned. All such payments to tenant shall not total more

than the aggregate of the payments of increase in operating costs theretofore

paid by tenant. In no event shall tenant be entitled to any payment that will

result in the reduction of tenant's rent below the rental herein originally

reserved, regardless of any reduction in operating costs. The obligation of

tenant as well as that of landlord to make the payments required of them

respectively as above set forth survive any termination of this lease, except

that landlord's obligation does not survive if this lease is terminated because

of tenant's default.

(c). As a condition to collecting any payment for

increase in operating costs, landlord shall submit to tenant a statement

("escalation statement") as soon as may be reasonably practicable

after the close of any subsequent year for which landlord claims there has been

an increase in operating costs, which statement shall show the applicable

increase for such year, and tenant's share thereof; and tenant's payment of

such share shall be due within 20 days after the rendition of the statement.

(d). If tenant shall have paid any increase for a

subsequent year, then landlord shall thereafter, as soon as practicable after

the end of such subsequent year, submit an escalation statement for such

subsequent year, as long as tenant may be entitled to share in any reduction in

operating costs as above provided; and if tenant shall be entitled to share in

any such reduction, the amount of tenant's share shall accompany the escalation

statement.

(e). If for any subsequent year for which a rise in

operating costs over the base year costs reflects an increase in real estate

taxes over those levied for the base year, landlord shall obtain a reduction in

real estate taxes for such subsequent year after tenant shall have paid its

share of the increase in operating costs for that year as above provided, then

landlord will refund to tenant its ratable share of the net refund received by

landlord (i.e., after deducting all of landlord's expenses in connection with

the refund). Landlord does not assume any duty or obligation to contest the

levy or assessment of any real estate taxes, and it shall be in the landlord's

sole discretion whether any such contest shall be undertaken—the landlord

hereby reserving the exclusive right to take and prosecute all such proceedings;

and if so taken, including any such proceedings taken for the base year, the

landlord may proceed without any notice to tenant and may prosecute the

proceeding (including settlement and discontinuance) in such manner as it may

determine in its sole discretion. However, if tenants of landlord in the

building who occupy in the aggregate not less than _____% of the rentable area

of the building shall notify landlord in writing that they wish the landlord to

contest the real estate taxes for a particular tax year and such notice is

given to landlord sufficiently in advance of the last day to initiate such

contest in the regular and normal course of business, then landlord will so

initiate such contest, but subject nevertheless to all the other provisions

above set forth regarding the contest of real estate taxes. If such contest so

initiated at the request of tenants is unsuccessful or if the expense thereof

exceeds the refund, tenant, if it is one of those who requested the contest,

shall pay landlord upon demand, as additional rental, its share of the expenses

or such part thereof as exceeds the refund, in the ratio of tenant's rentable

area to the rentable area of all tenants who participated in making the

request. When used above the expressions "contest" and

"proceedings" include both administrative and judicial contests and

proceedings.

Contributed by

FastDue.com |

|

|

Name of Firm |

FastDue.com |

|

Location |

Fairfield,

Iowa,

United States |

|

Total Forms Contributed |

74 |

|

Phone |

641-209-1761 |

|

Website |

http://fastdue.com |

|

Email |

|

|

Free online business forms for all your invoicing and collection needs.

100% FREE, no login required, easy and secure. |

See All

FastDue.com's Forms |

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

Keywords: free rental agreement, rental addendum

|

|

|