|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

Primary area of practice |

please specify field of law here:

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

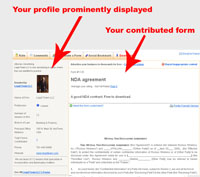

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

|

Advertise your business to thousands for free –

Contribute a form

|

|

Form #1184General lease agreement

|

General lease agreement - free to download

|

Need this form customized?

Need this form customized? |

Download This Form

Download This Form

|

Printer Friendly Version

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your

agreement to hold this site, its officers, employees and any contributors to this

site harmless for any damage you might incur from your use of any submissions contained

on this site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice. YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

|

General form.

This lease made _________[year], between

_________, of the city of _________, state of _________, as lessor, and

_________, of the same place [or as the case may be], as lessee, witnesses:

A. Grant of Lease, Description of Property, and

Duration of Lease

Lessor, in consideration of rents herein reserved and

of agreements herein of lessee, to be kept, performed and fulfilled, leases to

lessee the following-described premises situated and being in city of

_________, county of _________ and state of _________: _________.

To have and to hold above-described premises, with

rights, privileges, easements and appurtenances thereunto attaching and

belonging, to lessee for the term of 99 [or as the case may be] years from and

after first day of _________ in [year]; that is to say, from the first day of

_________, in [year] until the 30th day of _________ in year _________, paying

rent therefor, and yielding possession thereof as herein provided.

B. Rent

1. Lessee agrees to pay to lessor as rent for premises

$_____, payable in monthly [or as the case may be] instalments on the

_________ day of each month [or as the case may be] at _________.

2. Any instalment of rent accruing under provisions of

this lease, which shall not be paid when due, shall bear interest at rate of

_____% per annum from date when same was payable by terms of this lease until

same shall be paid by lessee.

3. The moneys due hereunder as rent shall always be a

first lien on the land and improvements on the premises.

4. If lessee shall be ousted from possession of

premises by reason of any defect in title of lessor, lessee shall not be

required to pay any rent under this lease while so deprived of possession of

premises, and lessor shall not incur any liability by such ouster beyond loss

of rent while lessee is so deprived of possession of premises.

C. Construction of Building by Lessee

1. Lessee agrees to erect, finish and complete at

lessee's own expense, with all reasonable dispatch, and with no further delays

than may be necessary and unavoidable, on the premises, a fireproof building in

a good and suitable manner, and have the same, in any event, complete and ready

for occupancy and fully paid for, and free from all mechanics' liens and free

from any and all claims liable to ripen into mechanics' liens, on or before the

first day of _________[year], which building shall be _________[insert

provisions as to kind of building, height, value of, or whatever agreed on as

to sufficiency of building].

2. No building erected under the provisions of this

lease shall be removed or torn down without written consent of lessor.

D. Bond of Lessee

Lessee shall execute to lessor contemporaneously with

this lease, a bond in the sum of $_____, with surety satisfactory to lessor,

providing for erection of such building, together with payment of rent, taxes,

assessments and any obligations hereunder until erection and completion of

building whereupon bond shall be cancelled and released. Such bond shall

further provide that _________.

E. Assignment of Lease

1. Lessee agrees to not assign this lease, except by

way of mortgage, until lessee shall have completed and paid for building on

premises, of character and within time herein specified.

2. Lessee may, when there is a building erected which

shall conform to requirements of this lease and free from mechanics' liens and

possibility thereof and similar claims, sell or assign lessee's interest in

premises and buildings thereon, provided that all rents, taxes, assessments,

insurance and other charges of every kind shall be paid to date of such

assignment, and all agreements herein contained to be kept and performed by

lessee, shall be fully complied with at date of such assignment or conveyance.

In case of such sale or assignment of lease, same shall be evidenced in

writing, duly executed under seal and acknowledged by assignee, and duly

recorded in recorder's office of _________ county and state of _________

whereupon and whereby assignee shall expressly accept and assume all terms and

agreements in this lease contained to be kept and performed by lessee, and will

comply with and be bound by them; lessee agrees to not make any assignment of

this lease, except in manner and on conditions as set forth above, and any

assignment of the lease, leasehold interest or buildings on the property, not

in strict conformity with these provisions, shall be null and void.

3. Assignee, and succeeding assignees, shall be

subject to same terms and conditions as to future assignments, and the lessee

herein so assigning and conveying shall thereof and thereby then be forever

released and discharged from this lease and from agreements in this lease

contained, providing assignment shall have been made to be carried into effect

an absolute and bona fide sale of lessee's interest in premises.

F. Taxes, Special Assessments, Public Service Charges,

and the Like

1. Lessee agrees to pay all taxes and assessments,

general and special, and all other impositions, ordinary and extraordinary, of

every kind and nature whatever, levied or assessed on premises, or any part

thereof, or on any buildings or improvements at any time situated thereon or

levied or assessed on interest of lessors in or under this lease during the

term of lease, all of which taxes, assessments and other impositions shall be

paid by lessee in name of lessor within 20 days after the same shall become due

and payable, and in any case within apt time to prevent any sale or forfeiture

of premises therefor, or for any part thereof, it being agreed that lessee

shall pay 5/6 of the general taxes levied on premises for year [year], and

shall pay all of the general annual taxes levied on premises for each and every

year thereafter during the term hereby demised, including 1/6 [or as the case

may be] of general taxes for year [year].

2. Nothing herein contained shall be construed to

require lessee to pay any so-called income taxes assessed on or in respect of

income of lessor, or any income taxes chargeable to, or required to be paid by,

lessor unless income taxes shall be specifically levied against income of

lessor derived from rent by this lease reserved expressly as and for a specific

substitute for the taxes, in whole or in part, on real estate by this lease

demised; nor shall anything in this lease contained be construed to require

lessee to pay any so-called inheritance, estate or transfer tax growing out of

any inheritance, devise or transfer of lessor's estate, or of any interest in

reversion of real estate; provided, however, that if amount or rate of such

income taxes so specifically levied against income of lessors as a specific

substitute for taxes on real estate by this lease demised should be increased

by reason of any other income received or property owned by lessor, then lessee

shall not be obligated to pay such increased amount or excess but only such tax

as lessor would be obligated to pay in case they derived no income from any

other source than the real estate.

3. Lessee shall have the right to contest the validity

of any tax or special assessment payable by lessee which lessee deems to have

been illegally levied or assessed against premises, and for that purpose shall

have the right to institute such proceeding or proceedings in the name of

lessor as lessee may deem necessary, provided that expenses incurred by reason

thereof shall be paid by lessee and provided further it is necessary to use

lessor's name in carrying on such proceedings.

4. Whenever any taxes or special assessments may be

paid in instalments, lessee shall have the right to execute in name of lessor

and as lessor's attorney in fact such agreement or agreements as may be

required or permitted by law to secure right or privilege of paying such taxes

or special assessments in instalments and lessee shall thereupon pay instalments

before they become delinquent. Lessee shall pay prior to the termination of

this lease all deferred instalments of any such taxes or special assessments.

5. Lessee agrees to deliver to lessor from time to

time duplicate receipts showing payment of all taxes, assessments and other

impositions within 30 days after respective payments evidenced thereby.

G. Condemnation of Leased Property

If the entire premises be taken by appropriation to

public use, under right of eminent domain, during term of this lease, this

lease shall terminate and award received for taking shall be divided between

lessor and lessee as follows: _________.

H. Insurance

1. Lessee shall keep insured during demised term any

and all buildings or improvements that may be built or placed on premises, in a

good and responsible company or companies, as may be approved by lessor, to an

amount of not less than $_____, and all policies issued, and renewals thereof,

of all such insurance on the buildings or improvements to the amount of $_____

are to be assigned to, and in case of loss be made payable to, lessor, as

lessor's interest may appear, the same to be held by lessor as additional

security for the amount of rent and the rebuilding herein provided for; and

lessor, in case the buildings or improvements shall at any time or times be

destroyed by fire during the term, shall pay to lessee, on proper architect's

certificates, so much of the insurance money as may be received by reason of

such loss or destruction, in such sum or sums as may be necessary to pay for

rebuilding as herein provided; and at the time when such insurance money is

paid by lessor, lessee shall expend on work done on or for materials furnished

for the restoration, repair or erection of any new building, an amount of money

derived by lessee from sources other than such insurance money paid out by

lessor, equal to the amount of the portion so paid by lessor. No interest is to

be paid on insurance money by lessor during the time such money remains in

lessor's possession; and any and all moneys which lessor shall receive by

reason of any loss or destruction of the buildings or improvements is hereby

constituted a trust fund, to be used for rebuilding of buildings and

improvements on premises, as herein provided for. Lessor shall properly

disburse such moneys and use such toward rebuilding the buildings and

improvements on the premises, as herein provided for; but this provision shall

not prejudice the provisions in this lease contained, that such insurance money

shall stand as additional security for the rent herein provided for. Lessor

shall not be responsible for the collection or noncollection of any insurance

money in any event, but only for such insurance money as shall come to lessor's

hands.

2. In case lessee shall neglect to insure and keep

insured the buildings and improvements on premises, lessor may, at lessor's

election, procure and renew such insurance and add the amount paid therefor to

the instalment of rent next falling due under this lease, together with interest

at the rate of _____% per annum.

I. Mortgage by Lessee

Lessee may at any time mortgage or convey by deed of

trust in the nature of a mortgage, lessee's estate in premises and any building

or improvement then or thereafter situated thereon; provided, that lessee shall

not be in default in any of agreements herein contained to be kept, observed

and performed by lessee and shall have paid all rents, taxes, assessments,

insurance premiums and all other charges of every kind which shall have accrued

hereunder; and provided further, that no mortgagee or trustee or anyone to

claim by, through or under such mortgage or deed of trust, shall, by virtue

thereof, acquire any greater rights in premises and any building or improvement

thereon than lessee then has under this lease; and provided further, that such

mortgage or deed of trust shall be subject to all the conditions and

obligations of this lease and to the rights of lessor thereunder.

J. Use of Leased Property

[There is, it seems, no difference in provisions in leases

as to the purposes for which leased premises are to be used, including

forbidding use for illegal purposes, as between short-term and long-term

leases.]

K. Option To Purchase Property

Lessee shall have the right to purchase the premises

on or before _________[year], for the sum of $_____, on condition that

_________, and a deed executed by lessor on exercise of such option shall

terminate this lease.

L. Payments by Lessor Recoverable from Lessee

1. Lessor shall have the right at all times during

demised term, to pay any rates, taxes, assessments, water rates or other

charges on premises and reversionary interest therein remaining unpaid after

the same have become due and payable, and to pay, cancel and clear off all tax

sales, liens, charges and claims on or against premises or reversionary

interest therein, and to redeem premises from the same, or any of them, from

time to time, and the amount paid, including reasonable expenses, shall be so

much additional rent due from lessee at next rent day after any such payment,

with interest thereon at the rate of _____% per annum from the date of payment

thereof by lessor, until the repayment thereof to lessor by lessee.

If lessor shall advance or pay any such rates, taxes,

assessments, water rates or other charges, or any, cancel and clear off any tax

sales, liens, or charges and claims on and against premises or the reversionary

interest therein, it shall not be obligatory on lessor to inquire into the

validity of any such rate, tax or assessment, or other charge, or any such tax

sale.

2. Lessor shall have right at all times during demised

term, to pay any taxes, assessments, water rates or other charges or

impositions on premises, the building at any time situated thereon, or any interest

therein, remaining unpaid after same shall become delinquent, and to pay,

cancel and clear off all liens, charges and claims on or against premises, and

to redeem premises from same, or any of them, from time to time, and amount so

paid, including reasonable expenses, shall be so much additional rent due from

lessee to lessor at next rent day after any such payment, with interest at rate

of _____% per annum from date of payment thereof by lessor until repayment

thereof to lessor by lessee, it being agreed however (all other provisions of

this lease to contrary notwithstanding), that lessee shall not be required to

pay, discharge or remove any tax, assessment, tax lien, or other imposition or

charge on or against premises, or any part thereof, or improvements at any time

situated thereon so long as lessee shall in good faith proceed to contest same,

or validity thereof, by appropriate legal proceedings, which shall operate to

prevent collection of tax, assessment, lien or imposition so contested, or sale

of premises or any part thereof to satisfy same, provided, however, lessee, not

less than 20 days before any tax, assessment, lien or imposition on premises

shall become delinquent, shall give notice to lessor of their intention to

contest validity of same and shall deposit with lessor cash or marketable

securities satisfactory to lessor in character and amount, to be held and

retained by lessor as security for tax, assessment, lien or imposition so

contested, which security shall be held by lessor until premises shall be

relieved and discharged from any such tax, assessment, lien or imposition and

shall thereupon be returned by lessor to lessee, less amount of any loss, cost,

damage and expense, including reasonable attorneys' fees that lessor may sustain

or incur in connection with tax, assessment, lien or imposition so contested,

and pending any such legal proceedings lessor shall not have the right to pay,

remove or discharge the tax, assessment, lien or other imposition so contested.

M. Payments by Lessee of Incumbrances on Leased

Property

If the interest on any incumbrance against the

property of which the premises form a part and to which incumbrance this lease

is subordinate, shall not have been paid at the time the same becomes due and

payable, lessee is hereby authorized, but not obligated, to pay same and charge

the amount so paid against the rents accruing under this lease and such payment

of interest shall in every respect have the same effect as though the amount

thereof had been paid as rent to lessor; and in event lessor shall not have

paid the principal of incumbrance or mortgage when the same becomes due,

whether by expiration of time or by reason of the mortgagee or incumbrancee

having declared the same to be due by reason of default, then lessee shall have

the right to purchase such incumbrance and deal with the same as its own

property, and such purchase of incumbrance shall not be deemed a merger, but

lessee so purchasing such incumbrance, or the notes secured thereby, shall in

all respects have the right to deal therewith as though lessee was in all

respects a stranger to the title to premises and not otherwise interested

therein; and in event of any foreclosure sale, lessee shall have the right, but

shall not be obligated, to purchase such property at such sale with like effect

of relief from any claim of merger arising therefrom.

N. Repairs

Lessee shall, at lessee's own expense, keep buildings

on premises in good repair and condition, so that security furnished by

buildings shall not at any time be impaired or diminished in value.

O. Loss or Damage by Fire

In case of loss or damage by fire or otherwise to any

building now or hereafter standing on premises, lessee will, within _________

months after such loss, injury or destruction, repair or rebuild the same in

such manner that the building on premises, after such repairing or rebuilding,

shall be of the same general character and at least equal in value to the

building which was standing on premises at the time of such loss, injury or destruction,

and lessee will pay for such repairing or rebuilding so that premises and the

building at any time situated thereon shall be free and clear of any and all

mechanics' and other similar liens and lessee will at all times during the

continuance of this lease keep and maintain on premises a building which shall

be of the same general character and at least equal in value to the building

now situated on premises.

P. Breach of Lease as Terminating Lease

In case, at any time, default shall be made by lessee,

in the payment of any of rent herein provided for on the day the same becomes

due or payable, and such default shall continue 30 days (after notice thereof

in writing by lessor, or their agents or attorneys to lessee), or in case any

default in relation to liens as herein provided shall continue 30 days after

written notice, or if lessee shall fail to pay any of the rates, taxes or

assessments herein provided for to be paid by lessee, within the time herein

provided for, or in case of the sale or forfeiture of premises, or any part

thereof, during demised term, for the nonpayment of any tax, rate or

assessment, or in case lessee shall fail to keep insured any building or

buildings or improvements which may at any time hereafter be on premises as

herein provided for, or fail to spend insurance money as herein provided for,

or fail to rebuild as herein provided, or fail in any of the agreements of this

lease by lessee to be kept or performed, then in any or either of such events,

it shall and may be lawful for lessor at or after the expiration of 10 days'

previous notice in writing to declare demised term ended and into premises, and

the buildings and improvements situated thereon, or any part thereof, either

with or without process of law, to reenter, lessee hereby waivering any demand

for possession of premises and any and all buildings and improvements then

situated thereon. And lessee agrees that on termination of demised term at such

election of lessor, or in any other way, lessee will surrender and deliver up

premises and property peaceably to lessor, lessor's agents or attorneys,

immediately upon the termination of demised term; and if lessee, lessee's

agents, attorneys and tenants shall hold premises or any part thereof one day

after the same should be surrendered according to the terms of this lease, they

shall be deemed guilty of forcible detainer of premises under the statute, and

shall be subject to eviction and removal, forcibly or otherwise, with or

without process of law.

Q. Forfeiture to Lessor of Improvements on Termination

of Lease for Breach

In event of determination of this lease at any time

before expiration of term of _________ years, for breach by lessee of any of

agreements herein contained, all buildings, fixtures and improvements then

situated on premises shall be forfeited to lessor and become lessor's property,

and no compensation therefor shall be allowed or paid to lessee.

R. Purchase by Lessor on Termination of Lease by

Expiration of Time

Lessor agrees to purchase on _________ day of

_________ in [year], unless this lease is sooner determined in any of ways

herein provided, the buildings and improvements situated and standing on

premises, exclusive of and not including value of the land or ground, at their

actual cash value agreed on or determined by _________; purchase money to be

payable one quarter in cash and the balance in _________ years from the

_________ day of _________[year], with interest thereon at the rate of

_____% per annum, such deferred payments to be secured by a first mortgage on

premises and improvements or by such other securities as may be satisfactory to

lessee, or if lessor so desires lessor may pay the entire sum of such purchase

money in cash.

And lessee

agrees that at the time and upon the day of purchase, to wit:_________, at

twelve o'clock noon, to convey all of buildings and improvements to lessor by a

good and sufficient deed of conveyance, and will immediately surrender and

deliver up peaceably premises in as good condition as when the same were entered

upon by lessee, and any and all buildings and improvements thereon in a good

and perfect condition, ordinary wear and tear, depreciation and decay excepted.

It being, however, agreed that it is a condition of this lease that all

buildings and improvements and fixtures on premises at termination of demised

term, providing this lease is not sooner determined, shall, at and

upon the date of the expiration of the term, revert to

and become the exclusive property of and be vested in lessor without any such

deed of conveyance from lessee to lessor, but this condition is not to be so

construed as to waive the right of lessee of the payment to lessee of the

actual cash value of such improvements on the premises, to be ascertained and

determined as aforesaid.

S. Costs and Attorney Fees

In case lessor shall, without any fault, be made party

to any litigation commenced by or against lessee, lessee shall pay all costs

and attorney's fees incurred by or against lessor, by or in connection with

such litigation, and lessee shall and will also pay all costs and attorney's

fees incurred by or against lessor, in enforcing agreements and provisions of

this lease; and all such costs and attorney's fees, if paid by lessor, or

either of them, and the rent reserved in this lease, and all taxes and

assessments, and the payment of all money provided in this lease to be made to

lessor, shall be and they are hereby declared to be a first lien on all

buildings and improvements placed on premises at any time during the term of

this lease, and on the leasehold estate hereby created, and on the rents of all

buildings and improvements situated on premises at any time during the term.

T. Notices

In every case where, in the opinion of lessor, or

under the conditions of this lease, it shall be deemed necessary for interest

of lessor to serve a notice or demand on lessee concerning this lease, or any

of the conditions or provisions thereof, it shall be a sufficient service of

such notice, demand or declaration to leave a copy thereof at the place of

business of lessee, at _________ or by posting the same on the front of any

building then on premises.

U. Waivers

No waiver of a breach of any of the agreements or

provisions contained in this lease shall be construed to be a waiver of any

subsequent breach of the same or of any other provision in the lease.

V. Scope of Words Used

Each of the expressions, phrases, terms, conditions,

provisions, stipulations, admissions, promises, agreements, requirements and

obligations of this lease shall extend to and bind or inure to the benefit of

(as the case may require) not only the parties hereto, but each and every of

the heirs, executors, administrators and assigns of the parties hereto; and

wherever in this lease a reference to either of the parties hereto is made,

such reference shall be deemed to include, wherever applicable, also a

reference to the heirs, legal representatives and assigns of such party, the

same as if in every case expressed, and all the conditions and agreements

contained in this lease shall be construed as running with the land.

_________[spouse], of lessor, _________ joins

in this lease for the sole purpose of evidencing h— consent to its execution, and releasing h— right of [dower or courtesy, if applicable] in

premises as against lessee.

In witness whereof, the parties hereto have subscribed

their names [and set their seals] the day and year first above written.

[Acknowledgments]

[Signatures]

Contributed by

FastDue.com |

|

|

Name of Firm |

FastDue.com |

|

Location |

Fairfield,

Iowa,

United States |

|

Total Forms Contributed |

74 |

|

Phone |

641-209-1761 |

|

Website |

http://fastdue.com |

|

Email |

|

|

Free online business forms for all your invoicing and collection needs.

100% FREE, no login required, easy and secure. |

See All

FastDue.com's Forms |

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

Keywords: free lease agreement

|

|

|