|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

Primary area of practice |

please specify field of law here:

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

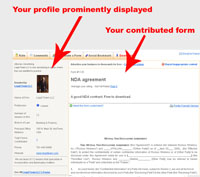

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

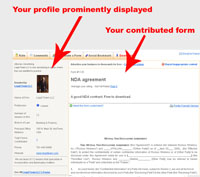

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

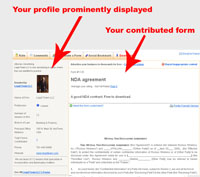

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

|

Advertise your business to thousands for free –

Contribute a form

|

|

Form #602Financial Proposal Forms

|

Average user rating: |

Not Yet Rated

|

Rate it |

|

Financial Proposal Forms - free to use

|

Need this form customized?

Need this form customized? |

Download This Form

Download This Form

|

Printer Friendly Version

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your

agreement to hold this site, its officers, employees and any contributors to this

site harmless for any damage you might incur from your use of any submissions contained

on this site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice. YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

|

[Comments in brackets [ ]

provide guidance to the shortlisted Consultants for the preparation of their

Financial Proposals; they should not appear on the Financial Proposals to be

submitted.]

Financial Proposal Standard Forms shall be

used for the preparation of the Financial Proposal according to the

instructions provided under para. 3.6 of Section 2. Such Forms are to be used

whichever is the selection method indicated in para. 4 of the Letter of Invitation.

[The Appendix “Financial Negotiations -

Breakdown of Remuneration Rates” is to be only used for financial negotiations

when Quality-Based Selection, Selection Based on Qualifications, or

Single-Source Selection method is adopted, according to the indications

provided under para. 6.3 of Section 2.]

FIN-1 Financial Proposal Submission Form

FIN-2 Summary of Costs

FIN-3 Breakdown of Costs by Activity

FIN-4 Breakdown of Remuneration

FIN-5 Reimbursable expenses

Appendix: Financial Negotiations

- Breakdown of Remuneration Rates

Form FIN-1 Financial Proposal Submission Form

[Location,

Date]

To: [Name and address of Client]

Dear Sir,

We, the undersigned, offer to provide the consulting

services for [Insert title of assignment] in accordance with

your Request for Proposal dated [Insert Date] and our Technical

Proposal. Our attached Financial Proposal is for the sum of [Insert amount(s)

in words and figures1]. This amount is exclusive of the taxes,

which shall be identified during negotiations and shall be added to the above

amount.

Our Financial Proposal shall be binding upon us

subject to the modifications resulting from Agreement negotiations, up to

expiration of the validity period of the Proposal, i.e. before the date

indicated in Paragraph Reference 1.12 of the Data Sheet.

No commissions or gratuities have been or are

to be paid by us to agents relating to this Proposal and Agreement execution.

We understand you are not bound to accept any

Proposal you receive.

We remain,

Yours sincerely,

Authorized Signature [In full and initials]:

Name and Title of Signatory:

Name of Firm:

Address:

Form FIN-2 Summary of Costs

|

Item

|

Costs

|

|

[Indicate

Foreign Currency # 1]1

|

Pak

Rupees

|

|

Total Costs of Financial Proposal 2

|

|

|

1 Indicate between brackets the

name of the foreign currency.

2 Indicate the total costs, net

of local taxes, to be paid by the Client in each currency. Such total costs

must coincide with the sum of the relevant Subtotals indicated in all Forms

FIN-3 provided with the Proposal.

Form FIN-3

Breakdown of Costs by Activity1

|

Group of Activities (Phase):2

|

Description:3

|

|

Cost component

|

Costs

|

|

[Indicate Foreign Currency # 1]4

|

Pak

Rupees

|

|

Remuneration5

|

|

|

|

Reimbursable Expenses 5

|

|

|

|

Subtotals

|

|

|

Form FIN-4

Breakdown of Remuneration1

(This Form FIN-4

shall only be used when the Time-Based Form of Agreement has been included in

the RFP)

|

Group

of Activities (Phase):

|

|

Name2

|

Position3

|

Staff-month Rate4

|

Input5

(Staff-months)

|

[Indicate Foreign Currency # 1]6

|

Pak

Rupees

|

|

Foreign

Staff

|

|

|

|

|

|

|

|

|

[Home]

|

|

|

|

|

[Field]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Local

Staff

|

|

|

|

|

|

|

|

|

[Home]

|

|

|

|

|

[Field]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Costs

|

|

|

1 Form FIN-4 shall be filled for

each of the Forms FIN-3 provided.

2 Professional Staff should be

indicated individually; Support Staff should be indicated per category (e.g.:

draftsmen, clerical staff).

3 Positions of Professional

Staff shall coincide with the ones indicated in Form TECH-5.

4 Indicate separately

staff-month rate and currency for home and field work.

5 Indicate, separately for home

and field work, the total expected input of staff for carrying out the group of

activities or phase indicated in the Form.

6 Indicate between brackets the

name of the foreign currency. For each staff indicate the remuneration in the

column of the relevant currency, separately for home and field work.

Remuneration = Staff-month Rate x Input.

Form FIN-4

Breakdown of Remuneration1

(This

Form FIN-4 shall only be used when the Lump-Sum Form of Agreement has been

included in the RFP. Information to be provided in this Form shall only be

used to establish payments to the Consultant for possible additional services

requested by the Client)

|

Name2

|

Position3

|

Staff-month

Rate4

|

|

Local

Staff

|

|

|

|

|

|

[Home]

|

|

[Field]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign

Staff

|

|

|

|

|

|

[Home]

|

|

[Field]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Form FIN-4 shall be filled in

for the same Professional and Support Staff listed in Form TECH-7.

2 Professional Staff should be

indicated individually; Support Staff should be indicated per category (e.g.:

draftsmen, clerical staff).

3 Positions of the Professional

Staff shall coincide with the ones indicated in Form TECH-5.

4 Indicate separately

staff-month rate and currency for home and field work.

Form FIN-5 Breakdown of Reimbursable Expenses1

(This Form FIN-5

shall only be used when the Time-Based Form of Agreement has been included in

the RFP)

|

Group

of Activities (Phase):

|

|

N°

|

Description2

|

Unit

|

Unit Cost3

|

Quantity

|

[Indicate Foreign Currency # 1]4

|

Pak Rupees

|

|

|

Per diem

allowances

|

Day

|

|

|

|

|

|

|

International

flights5

|

Trip

|

|

|

|

|

|

|

Miscellaneous

travel expenses

|

Trip

|

|

|

|

|

|

|

Communication

costs between [Insert place] and [Insert place]

|

|

|

|

|

|

|

|

Drafting,

reproduction of reports

|

|

|

|

|

|

|

|

Equipment,

instruments, materials, supplies, etc.

|

|

|

|

|

|

|

|

Shipment

of personal effects

|

Trip

|

|

|

|

|

|

|

Use of

computers, software

|

|

|

|

|

|

|

|

Laboratory

tests.

|

|

|

|

|

|

|

|

Subagreements

|

|

|

|

|

|

|

|

Local

transportation costs

|

|

|

|

|

|

|

|

Office

rent, clerical assistance

|

|

|

|

|

|

|

|

Training

of the Client’s personnel 6

|

|

|

|

|

|

|

Total

Costs

|

|

|

1 Form FIN-5 should be filled for

each of the Forms FIN-3 provided, if needed.

2 Delete items that are not

applicable or add other items according to Paragraph Reference 3.6 of the Data

Sheet.

3 Indicate unit cost and currency.

4 Indicate between brackets the

name of the foreign currency. Indicate the cost of each reimbursable item in

the column of the relevant currency. Cost = Unit Cost x Quantity.

5 Indicate route of each flight,

and if the trip is one- or two-ways.

6 Only if the training is a major

component of the assignment, defined as such in the TOR

Form FIN-5 Breakdown of Reimbursable Expenses

(This

Form FIN-5 shall only be used when the Lump-Sum Form of Agreement has been

included in the RFP. Information to be provided in this Form shall only be

used to establish payments to the Consultant for possible additional services

requested by the Client)

|

N°

|

Description1

|

Unit

|

Unit

Cost2

|

|

|

Per diem

allowances

|

Day

|

|

|

|

International

flights3

|

Trip

|

|

|

|

Miscellaneous

travel expenses

|

Trip

|

|

|

|

Communication

costs between [Insert place] and [Insert place]

|

|

|

|

|

Drafting,

reproduction of reports

|

|

|

|

|

Equipment,

instruments, materials, supplies, etc.

|

|

|

|

|

Shipment

of personal effects

|

Trip

|

|

|

|

Use of

computers, software

|

|

|

|

|

Laboratory

tests.

|

|

|

|

|

Subagreements

|

|

|

|

|

Local

transportation costs

|

|

|

|

|

Office

rent, clerical assistance

|

|

|

|

|

Training

of the Client’s personnel 4

|

|

|

1 Delete items that are not

applicable or add other items according to Paragraph Reference 3.6 of the Data

Sheet.

2 Indicate unit cost and currency.

3 Indicate route of each flight,

and if the trip is one- or two-ways.

4 Only if the training is a major

component of the assignment, defined as such in the TOR.

Appendix

Financial

Negotiations - Breakdown of Remuneration Rates

(Not to be used when cost is a factor in the

evaluation of Proposals)

1. Review of Remuneration Rates

1.1 The

remuneration rates for staff are made up of salary, social costs, overheads,

fee that is profit, and any premium or allowance paid for assignments away from

headquarters. To assist the firm in preparing financial negotiations, a Sample

Form giving a breakdown of rates is attached (no financial information should

be included in the Technical Proposal). Agreed breakdown sheets shall form

part of the negotiated agreement.

1.2 The

Client is charged with the custody of government funds and is expected to

exercise prudence in the expenditure of these funds. The Client is, therefore,

concerned with the reasonableness of the firm’s Financial Proposal, and, during

negotiations, it expects to be able to review audited financial statements

backing up the firm’s remuneration rates, certified by an independent auditor.

The firm shall be prepared to disclose such audited financial statements for

the last three years, to substantiate its rates, and accept that its proposed

rates and other financial matters are subject to scrutiny. Rate details are

discussed below.

(i) Salary

This is the gross regular cash salary

paid to the individual in the firm’s home office. It shall not contain any

premium for work away from headquarters or bonus (except where these are

included by law or government regulations).

(ii) Bonus

Bonuses are normally paid out of

profits. Because the Client does not wish to make double payments for the same

item, staff bonuses shall not normally be included in the rates. Where the

Consultant’s accounting system is such that the percentages of social costs and

overheads are based on total revenue, including bonuses, those percentages

shall be adjusted downward accordingly. Any discussions on bonuses shall be

supported by audited documentation, which shall be treated as confidential.

(iii) Social

Costs

Social costs are the costs to the firm

of staff’s non-monetary benefits. These items include, inter alia,

social security including pension, medical and life insurance costs, and the

cost of a staff member being sick or on vacation. In this regard, the cost of

leave for public holidays is not an acceptable social cost nor is the cost of

leave taken during an assignment if no additional staff replacement has been

provided. Additional leave taken at the end of an assignment in accordance with

the firm’s leave policy is acceptable as a social cost.

(iv) Cost

of Leave

The principles of calculating the cost

of total days leave per annum as a percentage of basic salary shall normally be

as follows:

Leave cost as percentage of salary 1 =

It is important to note that leave can

be considered a social cost only if the Client is not charged for the leave

taken.

(v) Overheads

Overhead expenses are the firm’s

business costs that are not directly related to the execution of the assignment

and shall not be reimbursed as separate items under the agreement. Typical

items are home office costs (partner’s time, non-billable time, time of senior

staff monitoring the project, rent, support staff, research, staff training,

marketing, etc.), the cost of staff not currently employed on revenue-earning

projects, taxes on business activities and business promotion costs. During

negotiations, audited financial statements, certified as correct by an

independent auditor and supporting the last three years’ overheads, shall be

available for discussion, together with detailed lists of items making up the

overheads and the percentage by which each relates to basic salary. The Client

does not accept an add-on margin for social charges, overhead expenses, etc.,

for staff who are not permanent employees of the firm. In such case, the firm

shall be entitled only to administrative costs and fee on the monthly payments

charged for subcontracted staff.

(vi) Fee

or Profit

The fee or profit shall be based on the

sum of the salary, social costs, and overhead. If any bonuses paid on a

regular basis are listed, a corresponding reduction in the profit element shall

be expected. Fee or profit shall not be allowed on travel or other

reimbursable expenses, unless in the latter case an unusually large amount of

procurement of equipment is required. The firm shall note that payments shall

be made against an agreed estimated payment schedule as described in the draft

form of the agreement.

(vii) Away

from Headquarters Allowance or Premium

Some Consultants pay allowances to staff

working away from headquarters. Such allowances are calculated as a percentage

of salary and shall not draw overheads or profit. Sometimes, by law, such

allowances may draw social costs. In this case, the amount of this social cost

shall still be shown under social costs, with the net allowance shown

separately. For concerned staff, this allowance, where paid, shall cover home

education, etc.; these and similar items shall not be considered as

reimbursable costs.

(viii) Subsistence

Allowances

Subsistence allowances are not included in

the rates, but are paid separately and in pakistani currency. No additional

subsistence is payable for dependents¾the

subsistence rate shall be the same for married and single team members.

2. Reimbursable expenses

2.1 The financial

negotiations shall further focus on such items as out-of-pocket expenses and

other reimbursable expenses. These costs may include, but are not restricted

to, cost of surveys, equipment, office rent, supplies, international and local

travel, computer rental, mobilization and demobilization, insurance, and

printing. These costs may be either unit rates or reimbursable on the

presentation of invoices, in foreign or local currency.

3. Government of Punjab Guarantee

3.1 Payments to

the firm, including payment of any advance based on cash flow projections,

shall be made according to an agreed estimated schedule ensuring the firm

regular payments in local and foreign currency, as long as the services proceed

as planned.

Sample Form

Consulting

Firm:

Assignment: Date:

Consultant’s Representations Regarding Costs and

Charges

We hereby confirm that:

(a) the basic salaries

indicated in the attached table are taken from the firm’s payroll records and

reflect the current salaries of the staff members listed which have not been

raised other than within the normal annual salary increase policy as applied to

all the firm’s staff;

(b) attached are true copies

of the latest salary slips of the staff members listed;

(c) the away from

headquarters allowances indicated below are those that the Consultants have

agreed to pay for this assignment to the staff members listed;

(d) the factors listed in the

attached table for social charges and overhead are based on the firm’s average

cost experiences for the latest three years as represented by the firm’s

financial statements; and

(e) said factors for overhead

and social charges do not include any bonuses or other means of profit-sharing.

[Name of Consulting Firm]

Signature of

Authorized Representative Date

Name:

Title:

Consultant’s Representations Regarding Costs and

Charges

(Expressed in [insert

name of currency])

|

Personnel

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

8

|

|

Name

|

Position

|

Basic Salary

per Working Month/Day/Year

|

Social Charges1

|

Overhead1

|

Subtotal

|

Fee2

|

Away from

Headquarters Allowance

|

Proposed Fixed

Rate per Working Month/Day/Hour

|

Proposed Fixed

Rate per Working Month/Day/Hour1

|

|

Home Office

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Field

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Expressed as percentage of 1

2. Expressed as percentage of 4

Contributed by

FastDue.com |

|

|

Name of Firm |

FastDue.com |

|

Location |

Fairfield,

Iowa,

United States |

|

Total Forms Contributed |

74 |

|

Phone |

641-209-1761 |

|

Website |

http://fastdue.com |

|

Email |

|

|

Free online business forms for all your invoicing and collection needs.

100% FREE, no login required, easy and secure. |

See All

FastDue.com's Forms |

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

Keywords: financial, balance, legal forms, proposal forms

|

|

|