|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

Primary area of practice |

please specify field of law here:

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

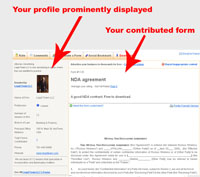

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

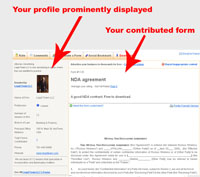

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

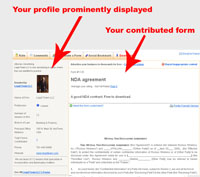

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

|

Advertise your business to thousands for free –

Contribute a form

|

|

Form #1258Basic agreement and plan of reorganization—"C" type

|

Average user rating: |

Not Yet Rated

|

Rate it |

|

Basic agreement and plan of reorganization—"C" type.

this form has not been reviewed by a lawyer

|

Basic agreement and plan

of reorganization—"C" type.

Agreement and plan of reorganization (referred to as

"agreement"), made the _________ day of _________[year], by

and between _________, a _________ corporation (referred to as

"purchaser"), and _________, a _________ corporation (referred to as

"seller") and the undersigned shareholders of seller (referred to as

"shareholders").

Plan of Reorganization

This plan of reorganization shall be a reorganization

within the meaning of Section 368(a)(1)(C) as amended. Purchaser, or a newly

formed, wholly-owned subsidiary of purchaser, shall acquire substantially all

of the properties, assets and business of seller in exchange solely for a part

of purchaser's voting common stock. As soon as practical seller will completely

liquidate and dissolve and will cause to be distributed to its shareholders,

pro rata to stock ownership, all of its right, title and interest in and to the

shares of purchaser's voting common stock to be received by seller in exchange

for the surrender by shareholders for cancellation of certificates representing

all of seller's outstanding common stock.

Agreement

In order to consummate the above plan of

reorganization, and in consideration of the mutual benefits to be derived and

the mutual agreements contained, the parties approve and adopt this agreement

and plan of reorganization and mutually covenant and agree as follows:

1. Assets To Be Transferred, Liabilities To Be

Assumed, Shares To Be Issued and Dissolution of Seller.

1.1. Assets To Be Transferred.

On the closing date (defined), seller will convey,

transfer, assign and deliver to purchaser (or upon purchaser's request, to a

wholly-owned subsidiary of purchaser and designated by purchaser), and

purchaser will accept and acquire (or cause its wholly-owned subsidiary to

accept and acquire) all the business, property and assets of every kind and

wherever situated which are owned by seller, or in which it has any right or

interest, as of the closing date, except those provided in subparagraph 1.2.

1.2. Assets To Be Retained.

Seller shall retain:

(a) Cash not to exceed $_____ for expenses incurred by

seller arising from or attributable to the sale and exchange provided for by

this agreement and arising from or attributable to the dissolution, liquidation

and winding up of the affairs of seller,

(b) The consideration which purchaser agrees to pay

seller, and

(c) Seller's franchise to be a corporation, its

certificate of incorporation, corporate seal, stock books, minute book and

other corporate records having exclusively to do with the corporate organization

and capitalization of seller. Purchaser or its designated agents may have

reasonable access to books and records and may make excerpts.

1.3. Liabilities Not Assumed.

Anything to the contrary notwithstanding, purchaser

shall not assume or pay (i) any United States, foreign, state or other taxes

applicable to, imposed upon or arising out of the transfer of assets to

purchaser contemplated by this agreement, including but not limited to, any

income, transfer, sales, use, gross receipts or documentary stamp tax, (ii) any

liability of seller insured against, to the extent that liability is or will be

payable by an insurer, (iii) any liability, cost, obligation or expense

incurred in connection with this agreement and the transactions contemplated,

(iv) liabilities of seller for failure to perform any of its covenants

contained in this agreement, or (v) any obligations or liabilities of seller to

its shareholders as such.

1.4. Consideration To Be Given.

Upon the terms and conditions set forth in this agreement

and in exchange for the business, property and assets of seller to be

transferred, purchaser (or its designated subsidiary) in addition to assuming

all of seller's liabilities, other than those specified in subparagraph 1.3,

will issue and deliver to seller certificates representing _________ shares of

purchaser's common stock registered in the name of seller.

1.5. Adjustment for Stock Split.

If purchaser shall affect a split of its outstanding

common stock or affect a reclassification or combination of its outstanding

common stock by way of recapitalization, merger, consolidation or otherwise, or

declare a stock dividend payable to its shareholders of record with respect to

its common stock on the date or dates prior to the closing date, the number of

shares of common stock to be delivered to seller pursuant to subparagraph 1.4

shall in the case of a stock dividend be increased by the number of shares or

in the case of a stock split, combination or reclassification be changed into

the number of shares of common stock or other voting stock as the seller would

have been entitled to receive on account of that dividend, stock split,

reclassification or combination had the seller owned of record the shares to be

delivered under subparagraph 1.4 on the record date of the stock split,

combination, reclassification or payment of such dividend.

2. Representations and Warranties of Seller.

Seller represents and warrants as follows:

2.1. Organization and Authority.

(a). Seller is a corporation duly organized, validly

existing and in good standing under the laws of the State of _________ with all

requisite corporate power and authority to own, operate and lease its

properties and to carry on its business as now being conducted, and is duly

qualified and in good standing in every jurisdiction in which the property

owned, leased or operated by it or the nature of the business conducted by it

makes qualification necessary.

(b). Seller owns all of the outstanding stock of the

corporations which are listed on exhibit A (called the

"subsidiaries"). Subsidiaries are duly organized, validly existing

and in good standing under the laws of the states of their incorporation and

have all requisite corporate power and authority to own, operate and lease

their properties and to carry on their business as now being conducted and are

duly qualified and in good standing in every jurisdiction in which the property

owned, leased or operated by them or the nature of the business conducted by

them makes qualification necessary.

(c). The outstanding shares of seller and the

subsidiaries are legally and validly issued, fully paid and nonassessable. The

subsidiaries have not issued and do not have outstanding any option, warrant or

convertible securities or other right to purchase or convert any obligation

into such corporation's securities and have not agreed to issue or sell any

additional securities.

(d). Seller does not own 10 percent or more of the

outstanding stock of any corporation except those that it owns all of the

outstanding stock.

(e). The execution and delivery of this agreement does

not, and, subject to the approval and adoption by the shareholders of seller

contemplated, the consummation of the transaction contemplated will not violate

any provision of seller's certificate of incorporation or bylaws, or any

provisions of, or result in the acceleration of any obligation under, any

mortgage, lien, lease, agreement, instrument, court order, arbitration award,

judgment or decree to which seller or any of its subsidiaries is a party or by

which it or any of them is bound and will not violate any other restriction of

any kind or character to which it or any of them is subject.

2.2. Financials.

(a). True copies of the financial statements of seller

and its subsidiaries consisting of balance sheets as of the close of business

December 31, for each of the 5 years ended December 31, [year], and as of the

close of business _________[date], and the income statements for the

five years and _________ (_________) months ended _________[date], have

been delivered by seller to purchaser and are identified by the initials of

_________. These financial statements with the exception of those covering the

_________ (_________) months ended _________[date], have been examined

and certified by _________. All of the financial statements are true and

correct in all material respects and present an accurate and complete

disclosure of the financial condition of seller and its subsidiaries as of

their respective dates, and the earnings for the periods covered, in accordance

with generally accepted accounting principles applied on a consistent basis.

(b). All accounts receivable (net of reserves for

doubtful accounts) of seller and its subsidiaries shown on the books of account

on _________[date], and as incurred in the normal course of business

since that date, are collectible in the normal course of business.

(c). On _________[date], the inventories of

seller and its subsidiaries included in the balance sheet of that date had a

commercial value at least equal to the value shown in the balance sheet, all of

which are usable and are valued at cost or market, whichever is lower, and

assure a normal margin for each product line when sold.

(d). Seller and its subsidiaries have good and

marketable title to all of their assets, business and properties including,

without limitation, all properties reflected in the balance sheet as of _________[date],

except as disposed of in the normal course of business, free and clear of any

mortgage, lien, pledge, charge, claim or encumbrance, except as shown on the

balance sheet as of _________[date], and, in the case of real

properties, except for rights-of-way and easements which do not adversely

affect the use of property.

(e). All currently used property and assets of seller

and its subsidiaries, or in which they have an interest or which they have in

possession, are substantially in good operating condition and repair subject

only to ordinary wear and tear.

(f). The financial statements for seller and its

subsidiaries consisting of a consolidated balance sheet as of the close of

business December 31, [year], and a consolidated income statement for the year

[year] examined and certified by _________ and delivered at the closing shall:

(1) Be true and correct in all material respects and

present an accurate and complete disclosure of their financial condition as of

December 31, [year], earnings for the year [year];

(2) Satisfy the representation and warranties made in

subparagraphs (b), (c) and (d) of this subparagraph 2.2 as of the date the

representation and warranties were made with respect to the financial

statement;

(3) Disclose a consolidated book net worth in excess

of $_____;

(4) Disclose a consolidated net income after taxes of

in excess of $_____.

2.3. Changes Since .

Since _________[date], there has not been:

(a). Any material adverse change in the financial

condition of seller or its subsidiaries.

(b). Any loss, damage or destruction to the properties

of seller or its subsidiaries (whether or not covered by insurance) materially

adversely affecting their business or properties.

(c). Any change in the compensation pattern of seller

or its subsidiaries as established in preceding years, nor any material

increase in the compensation payable or to become payable to any of their

officers, directors, employees or agents, except as disclosed to purchaser in

writing.

(d). Any labor dispute or disturbance litigation or

event or condition of any character which materially adversely affects the

business or future prospects of seller or its subsidiaries.

(e). The issuance of additional shares of stock or

other securities by seller or its subsidiaries.

(f). Any distribution of assets, by way of dividends

or purchase of shares by seller or its subsidiaries except for _________.

(g). Any borrowings from financial institutions except

for _________.

(h). Any mortgage, pledge, lien or encumbrance made on

any of the properties or assets of seller or its subsidiaries other than

mechanics' and materialmen's liens arising in the normal course of business.

(i). Any sale, transfer or other disposition of assets

of seller or its subsidiaries, except in the normal course of business.

2.4. Liabilities.

(a). There are no liabilities of seller or its subsidiaries,

whether accrued, absolute, contingent or otherwise which arose or relate to any

transaction of seller, its subsidiaries, their agents or servants occurring

prior to _________[date], which are not disclosed by or reflected in the

financial statements, except as disclosed in Exhibit B. There are no

liabilities of seller or its subsidiaries which have arisen or relate to any

transaction of seller or its subsidiaries, their agents or servants, occurring

since _________[date], other than normal liabilities incurred in the

normal conduct of seller's or its subsidiaries' business, except as disclosed

in Exhibit B. As of this date there are no known circumstances, conditions,

happenings, events or arrangements, contractual or otherwise, which may give

rise to liabilities, except in the normal course of seller's or its

subsidiaries' business, except as disclosed in Exhibit B.

(b). All federal, state, county and local income, ad

valorem, excise, sales, use, gross receipts and other taxes and assessments

which are due and payable have been duly reported, fully paid and discharged as

reported by seller or its subsidiaries, and there are no unpaid taxes which are

or could become a lien on the properties and assets of seller or its

subsidiaries, except as provided for in the financial statements of _________[date],

or have been incurred in the normal course of seller's or its subsidiaries'

business since that date. All tax returns of any kind required to be filed have

been filed and the taxes paid or accrued. Seller's and its subsidiaries'

federal income tax returns have been audited through _________. Seller or its

subsidiaries have no knowledge of any possible deficiency assessments in

respect to federal income tax returns or other tax returns filed by them,

except as disclosed to purchaser in writing.

(c). All parties with whom seller or its subsidiaries

have contractual arrangements are in substantial compliance. Seller and its

subsidiaries are not in default in any material respect under any contracts to

which they are a party. All leases and contracts to which seller is a party are

assignable or the other party has consented to assignment.

(d). All corporate acts required of seller and its

subsidiaries have been taken and all reports and returns required to be filed

by them with any governmental agency have been filed. Seller and its

subsidiaries are in substantial compliance with all, and have no notice of any

claimed violation of any, applicable federal, state, county and local laws,

ordinances or regulations, including those applicable to discrimination in

employment, pollution and safety except as disclosed in Exhibit B.

(e). There are no legal, administrative or other

proceedings, investigations or inquiries, product liability or other claims,

judgments, injunctions or restrictions, either threatened, pending or

outstanding against or involving seller or its subsidiaries, or their assets,

properties, or business, nor does seller or its subsidiaries know, or have

reasonable grounds to know, of any basis for any proceedings, investigations or

inquiries, product liability or other claims, judgments, injunctions or

restrictions, except as disclosed in Exhibit B.

(f). All of the tangible real and personal properties

of seller or its subsidiaries are in substantial compliance with applicable

laws, ordinances, rules and regulations of all public authorities having

jurisdiction thereover.

(g). Neither seller nor its subsidiaries have any

contract with any governmental body which is subject to renegotiation.

(h). The past and anticipated future operations of

seller and its subsidiaries do not infringe or violate any patents, patent

rights, trademarks, trade names, copyrights and/or licenses of others.

(i). To the knowledge of the officers of seller and

its subsidiaries there is no event, condition or trend of any character which

might materially and adversely affect the financial condition, business,

properties or assets of seller or any of its subsidiaries.

(j). The assets of seller and its subsidiaries are

adequately insured and all policies of insurance carried by seller and its

subsidiaries are in full force and all premiums are paid to date.

(k). All negotiations relative to this agreement and

the transaction contemplated have been carried on directly by seller with purchaser

without the intervention of any broker or third party. Seller has not engaged,

consented to or authorized any broker, investment banker or third party to act

on its behalf, directly or indirectly, as a broker or finder in connection with

the transaction contemplated by this agreement.

(l). There are no inquiries, investigations or pending

claims or litigation challenging or threatening to challenge seller's or its

subsidiaries' right, title and interest with respect to their continued use and

right to preclude others from using any patent, patent application, invention,

discovery, trademark, trade name and copyright of seller or any of its

subsidiaries.

(m). Neither seller nor any of its subsidiaries has

granted any license or made any assignment of any of their patents, patent

application, invention discovery, trademarks, trade names or copyrights, nor do

they pay any royalties or other consideration for the right to use any patents,

patent rights, trademarks, trade names or copyrights of others.

(n). To the knowledge of the officers of seller and

its subsidiaries, the seller and its subsidiaries are not a party to nor bound

by any agreement, deed, lease or other instrument which is so burdensome as to

materially affect or impair the operation of seller or its subsidiaries.

2.5. Accuracy of All Statements Made by Seller.

No representation or warranty by seller in this

agreement, nor any statement, certificate, schedule or exhibit furnished or to

be furnished by or on behalf of seller pursuant to this agreement, nor any

document or certificate delivered to purchaser pursuant to this agreement or in

connection with actions contemplated, contains or shall contain any untrue

statement of material fact or omits or shall omit a material fact necessary to

make the statement contained not misleading.

3. Representations and Warranties by Shareholders.

Each shareholder, as an inducement to cause purchaser

to enter into this agreement, severally represents and warrants that:

3.1. Ownership of Shares.

He [she] owns of record and beneficially the number of

shares set forth opposite his [her] signature to this agreement.

3.2. Cooperation.

He [she] will cooperate in all respects to the end

that the transactions contemplated by this agreement will be consummated and he

[she] will vote all of his [her] shares in favor of consummating this

agreement.

3.3. Contracts with Seller.

He [she] has no contracts or agreements with seller or

its subsidiaries.

3.4. Lack of Economic Interest in Competitor.

He [she] does not have (nor does any person who would

be his [her] heir or descendant if he [she] were not living or his [her]

spouse) any direct or indirect interest (except through ownership of securities

listed on a national securities exchange) in (i) any entity which does business

with seller or any of its subsidiaries or is competitive with their business or

(ii) any property, asset or right which is used by seller or any of its

subsidiaries in the conduct of their business.

3.5. Obligations to Seller.

All obligations of any shareholder (or any person who

would be an heir or descendant if he or she were not living or his or her

spouse), or any entity in which he or she has any interest (except through

ownership of securities listed on a national securities exchange), to seller

are listed as to amount, payment schedule and obligor on Exhibit C hereto.

3.6. Truth of Representations and Warranties.

To the best of shareholders' knowledge, all of the

representations of seller contained in paragraph 2 of this agreement are true

and correct.

4. Representations and Warranties of Purchaser.

Purchaser represents and warrants as follows:

4.1. Organization and Good Standing.

Purchaser is a corporation duly organized, validly

existing and in good standing under the laws of the state of _________.

4.2. Performance of This Agreement.

The execution and performance of this agreement and

the issuance of stock contemplated have been authorized by the board of

directors of purchaser.

4.3. Legality of Shares To Be Issued.

The shares of purchaser's common stock to be delivered

pursuant to this agreement, when delivered, will have been duly and validly

authorized and issued by purchaser and will be fully paid and nonassessable.

The shares of purchaser's common stock to be issued will have been listed for

trading on the New York Stock Exchange.

4.4. No Covenant as to Tax Consequences.

It is expressly understood and agreed that neither

purchaser nor its officers or agents has made any warranty or agreement,

expressed or implied, as to the tax consequences of the transactions

contemplated by this agreement or the tax consequences of any action pursuant

to or growing out of this agreement.

5. Covenants of Seller.

Seller covenants and agrees as follows:

5.1. Documents To Be Furnished.

Within ten days from the date of this agreement seller

will furnish to purchaser the following documents, lists and schedules

certified by a principal officer of seller as being accurate and complete:

(a) A list of the states of incorporation and states

qualified to do business of seller and its subsidiaries;

(b) A list of the authorized and outstanding

securities of seller and its subsidiaries;

(c) A list of the officers, directors and shareholders

of seller and its subsidiaries;

(d) Copies of the articles of incorporation and bylaws

currently in effect of seller and its subsidiaries;

(e) A list of the legal descriptions of all real

property owned of record or beneficially, or held under lease, or option, or

similar agreements by seller or its subsidiaries;

(f) Copies of all surveys and policies of title insurance

relating to real property owned by seller or its subsidiaries;

(g) Copies of all leases to which seller or any of its

subsidiaries is a party;

(h) Copies of all contracts, agreements or commitments

of seller or any of its subsidiaries, whether involving purchases, sales or

otherwise, which expire more than one year from the date of this agreement or

which involve an amount or value in excess of $_____;

(i) Copies of all collective bargaining or other union

contracts to which seller or any of its subsidiaries is a party;

(j) Copies of all employment contracts to which seller

or any of its subsidiaries is a party;

(k) Copies of all pension, retirement and profit

sharing plans to which seller or any of its subsidiaries is a party;

(l) A list of all fringe benefit plans and programs

applying to employees of seller or its subsidiaries, including but not limited

to, pension, profit sharing, life insurance, medical, bonus, incentive and

similar plans and the approximate annual cost of each;

(m) A list of all employees of seller and its

subsidiaries whose total remuneration for the year ended December 31, [year],

exceeded $_____;

(n) A list of all letters patent, patent applications,

inventions upon which patent applications have not yet been filed, trade names,

trademarks, trademark registrations and applications, copyrights, copyright

registrations, both domestic and foreign presently owned by seller or any of

its subsidiaries, together with the corporate owner;

(o) Any agreements to which seller or any of its subsidiaries

are parties with respect to any letters patent, patent applications, inventions

upon which patent applications have not yet been filed, trade names,

trademarks, trademark registrations and applications, copyrights and copyright

registrations;

(p) A list by major product lines of all distributors

and dealers for seller or any of its subsidiaries, together with representative

copies of franchise agreements, distribution contracts and policy statements

with a description of substantial modifications or exceptions;

(q) Copies of all financing or loan agreements,

mortgages or similar agreements to which seller or any of its subsidiaries is a

party;

(r) A list of all seller's and its subsidiaries' bank

accounts, brokerage accounts, safety deposit boxes, with the authorized signers

indicated;

(s) Copies of all powers of attorney granted by seller

or any of its subsidiaries;

(t) A list of each insurance policy owned by seller or

any of its subsidiaries, with the name of the insurance carrier, the policy number,

a brief description of the coverage, the annual premium, the corporate owner

and any claims pending;

(u) Sales for the last three (3) fiscal years made to

the five largest customers of seller and its subsidiaries;

(v) Purchases from any vendor during the last three

(3) fiscal years who accounted for over 10 percent of the purchases made by

seller and its subsidiaries;

(w) All sales commissions paid any individual or

entity of more than $_____ during the last three years and a description of the

present basis of paying sales commissions.

5.2. Actions Prior to Closing.

From and after the date of this agreement and until

the closing date:

(a). Purchaser and its authorized representatives

shall have full access during normal business hours to all properties, books,

records, contracts and documents of seller and its subsidiaries, and seller and

its subsidiaries shall furnish or cause to be furnished to purchaser and its

authorized representatives all information with respect to its affairs and

business of seller and its subsidiaries as purchaser may reasonably request.

(b). Except with the prior written consent of

purchaser, seller and its subsidiaries shall carry on their business diligently

and substantially in the same manner as before.

(c). Without the prior written consent of purchaser,

seller and its subsidiaries will not grant any general or uniform increase in

the rates of pay of its employees, nor grant any general or uniform increase in

the benefits under any pension plan or other contract or commitment, nor

increase the compensation payable or to become payable to officers or key

salaried employees, insurance, pension or other benefit plan, payment or arrangement

made to, for or with any of the officers, key salaried employees or agents.

(d). Seller and its subsidiaries shall not enter into

any contract or commitment or engage in any transaction not in the usual and

ordinary course of business and consistent with seller's and its subsidiaries'

business practices without the prior written consent of purchaser.

(e). Seller and its subsidiaries shall not create any

indebtedness other than that incurred in the usual and ordinary course of

business, that incurred pursuant to existing contracts disclosed in the

exhibits submitted, and that reasonably incurred in doing the acts and things

contemplated by this agreement.

(f). Seller and its subsidiaries shall not declare or

pay any dividend or make any distribution in respect of its capital stock;

shall not directly or indirectly redeem, purchase or otherwise acquire any of

its own stock; shall not grant any stock options; and shall not issue or in any

way dispose of any shares of its own stock.

(g). Subsidiaries shall not amend their certificates

of incorporation or bylaws or make any changes in authorized or issued capital

stock without the prior written consent of purchaser.

(h). Seller and its subsidiaries shall maintain

current insurance and any additional insurance in effect as may be reasonably

required by increased business and risks; and all property shall be used,

operated, maintained and repaired in a normal business manner.

(i). Seller and its subsidiaries shall use their best

efforts (without making any commitments on behalf of purchaser) to preserve

their business organization intact, to keep available to purchaser the present

key officers and employees of seller and its subsidiaries, and to preserve for

purchaser the present relationships of seller and its subsidiaries with their

suppliers and customers and others having business relations with them.

(j). Seller and its subsidiaries shall not do any act

or omit to do any act, or permit any act or omission to act, which will cause a

material breach of any material contract, commitment or obligation of seller

and its subsidiaries.

(k). Seller and its subsidiaries shall duly comply

with all applicable laws as may be required for the valid and effective

transfer of property, assets and business contemplated by this agreement,

except that purchaser waives compliance with the provisions of any bulk sales

act.

(l). Seller and its subsidiaries shall not sell or

dispose of any property or assets except products sold in the ordinary course

of business.

(m). Seller and its subsidiaries shall promptly notify

purchaser of any lawsuits, claims, proceedings or investigations that may be

threatened, brought, asserted or commenced against them, their officers or

directors involving in any way the business, properties or assets of seller or

any of its subsidiaries.

(n). Seller will provide purchaser with interim

monthly financial statements and any other management reports as and when they

are available.

5.3. Change of Corporate Name.

Seller agrees to change its corporate name to a new

name bearing no resemblance to its present name as promptly as practical after

the closing so as to permit the use of its present name by purchaser.

6. Conditions Precedent to Purchaser's Obligations.

Each and every obligation of purchaser to be performed

on the closing date shall be subject to the prior satisfaction of the following

conditions:

6.1. Truth of Representations and Warranties.

The representations and warranties made by seller and

shareholders in this agreement or given on its behalf, shall be substantially

accurate in all material respects on and as of the closing date with the same

effect as though the representations and warranties had been made or given on

and as of the closing date.

6.2. Compliance with Covenants.

Seller shall have performed and complied with all its

obligations under this agreement which are to be performed or complied with by

it prior to or on the closing date including the delivery of its documents

specified in subparagraph 5.1 and the closing documents specified in

subparagraph 13.2.

6.3. Absence of Suit.

No suit or proceeding shall be threatened or pending

in which it will be or it is sought, by anyone, to restrain, prohibit,

challenge or obtain damages or other relief in connection with this agreement

or the consummation of the transactions contemplated, or in connection with any

material claim against seller or any of its subsidiaries not disclosed or in

the exhibits.

6.4. Shareholder Authorization.

The sale of the business, property and assets of

seller in the manner contemplated by this agreement shall have been duly and

validly authorized by the holders of seller's stock issued and outstanding in

accordance with the laws of the State of _________.

6.5. No Material Adverse Change.

As of the closing date there shall not have occurred

any material adverse change which materially impairs the ability of seller and

its subsidiaries to conduct their business or the earning power on the same

basis as in the past.

6.6. Accuracy of Financial Statement.

Purchaser and its representatives shall be satisfied

as to the substantial accuracy of all balance sheets, statements of income and

other financial statements of seller furnished to purchaser.

6.7. Approval of Purchaser's Board of Directors.

This agreement shall have been approved by the board

of directors of purchaser.

6.8. Accountants' Comfort Letter.

Purchaser shall receive on or before the closing date

the accountants' comfort letter referred to in subparagraph 13.4(a).

6.9. Listing of Shares.

The shares of purchaser's common stock to be issued

pursuant to this agreement shall have been duly listed, or listed subject to

official notice of issuance, upon the New York Stock Exchange.

6.10. Employment Contracts.

Employment contracts referred to in subparagraph

13.2(e) shall have been executed.

6.11. Time Limit on Closing.

Closing shall have taken place by _________[date].

6.12. Legal Opinion.

Purchaser shall have received an opinion of counsel

for seller referred to in subparagraph 13.2(d).

7. Conditions Precedent to Seller's Obligations.

Each and every obligation of seller to be performed on

the closing date shall be subject to the prior satisfaction of the following

conditions:

7.1. Internal Revenue Service Ruling.

Receipt of a written ruling of the Internal Revenue

Service to the effect that the transaction contemplated by this agreement

qualifies as a tax-free reorganization and that the shareholders, upon receipt

of shares of purchaser pursuant to the agreement and plan of reorganization,

will not at that time have any taxable gain or deductible loss (except that

gain may be recognized by shareholders to the extent of sales for their account

of fractional shares to which they would otherwise be entitled).

7.2. Listing of Shares.

The purchaser's common stock to be delivered shall

have been listed, or listed subject to official notice of issuance upon the New

York Stock Exchange.

7.3. Truth of Representations and Warranties.

Purchaser's representations and warranties contained

in this agreement shall be true at and as of the closing date as though the

representations and warranties were made at and as of the transfer date.

7.4. Purchaser's Compliance with Covenants.

Purchaser shall have performed and complied with its

obligations under this agreement which are to be performed or complied with by

it prior to or on the closing date.

7.5. Time Limit on Closing.

Closing shall have taken place by _________[date].

8. Limitations on Survival and Effect of Certain

Warranties, Representations and Covenants.

All statements contained in any certificate,

instrument or document delivered by or on behalf of any of the parties pursuant

to this agreement and the transactions contemplated shall be deemed

representations and warranties by the respective parties.

8.1. Shareholders' Obligations.

The representations and warranties and covenants of

shareholders contained in this agreement shall survive the closing date, and

any investigation made by purchaser or its agents, and all representations,

warranties and covenants surviving shall be deemed joint and several.

8.2. Purchaser's Obligations.

The representations, warranties and covenants of

purchaser contained in this agreement shall survive the closing date.

9. Indemnification.

9.1. Requirement of Indemnification.

Shareholders shall indemnify purchaser for any loss,

cost, expense or other damage suffered by purchaser resulting from, arising out

of, or incurred with respect to the falsity or the breach of any

representation, warranty or covenant made by seller or shareholders which

survives the closing as provided in paragraph 8.

9.2. Notice.

Purchaser shall assert any right to indemnification by

furnishing _________, or any other person as may be designated in writing by

shareholders, with a written notice and list of charges detailed by item

showing the nature of any breach of any representation, warranty or covenant,

date of payment or assertion of claim, summary of settlement or litigation

procedures, and the amount of the loss, cost or expense. If the right to

indemnification is based on a claim of a third party, purchaser shall give the

notice within 120 days after purchaser has notice of any claim and shareholders

shall have the right to contest any such claim by a third party but all

expenses of the contest shall be borne by shareholders.

9.3. Resolution of Claim.

Except in the event that the claim for indemnification

is based upon a claim of a third party and shareholders shall have notified

purchaser that it will contest the claim, unless shareholders object to the

determination or computation of the total amount of the indemnification shown

on the written notice specified in subparagraph 9.2 within 60 days after

receipt, the total amount of indemnification shown by notice shall be paid by

shareholders to purchaser. If shareholders object to the determination

contained in the written notice specified in subparagraph 9.2 within 60 days

after receipt, they shall have the right to submit any claim for

indemnification not brought by a third party to the American Arbitration

Association for binding arbitration in accordance with its rules, and the

expenses of the American Arbitration Association shall be borne equally by the

parties.

9.4. Effect of Taxes.

The determination of any loss, cost or expense shall

take into account any tax benefit derived by purchaser or any affiliated

companies. To the extent that any deficiency for federal income taxes which may

be established against seller for any year ended on or prior to _________[year],

is occasioned by a determination by the Internal Revenue Service that any

increase in income for the year gives rise to a deduction or deductions from

ordinary income in the aggregate amount of seller for a subsequent taxable year

or years, this deficiency shall be assumed by purchaser and shall not be a

breach of any of seller or shareholders' warranties, representations and

covenants in this agreement.

9.5. Time Limit on Indemnification.

No claim for

indemnification may be asserted by purchaser after _________[date],

except for (i) income taxes for any period ending on or prior to _________[date],

which may be asserted at any time the Internal Revenue Service may still assert

a deficiency and (ii) claims arising out of a representation, warranty or

covenant that a

shareholder knew at the date of this agreement was

false or which arises out of a claim later known to a shareholder which

shareholder failed to disclose to an officer of purchaser prior to _________[date].

9.6. Amount Limit on Indemnification.

Notwithstanding any other provision to the contrary,

shareholders shall not be charged with any loss, cost or expense which in the

aggregate does not exceed $_____.

10. Covenant Not To Compete.

By execution, each shareholder agrees that for a

period of five (5) years from the closing date he or she will not either

directly or indirectly own, have a proprietary interest (except for less than

five percent (5%) of any listed company or company traded in the

over-the-counter market) of any kind in, be employed by, or serve as a

consultant to or in any other capacity for any firm, other than purchaser and

its subsidiaries, engage in the manufacture and distribution of _________, or

other products presently made or distributed by seller or any of its

subsidiaries, in the area where it is presently engaged in business without the

express written permission of purchaser. Each shareholder agrees that

compliance with the agreement contained in this paragraph is necessary to

protect the goodwill and other proprietary interest of seller and that a breach

of this agreement will result in irreparable and continuing damage to purchaser

for which there will be no adequate remedy at law and in the event of any

breach purchaser shall be entitled to injunctive and other and further relief

including damages as may be proper.

11. Security Act Provisions.

11.1. Restrictions on Disposition of Shares.

Shares of purchaser's common stock to be received

pursuant to this agreement shall be distributed by seller to the shareholders

who covenant and warrant that the shares so received are acquired for their own

accounts and not with the present view towards the distribution and will not

dispose of shares except (i) pursuant to an effective registration statement

under the Securities Act of 1933, as amended, or (ii) in any other transaction

which, in the opinion of counsel, acceptable to purchaser, is exempt from

registration under the Securities Act of 1933, as amended, or the Rules and

Regulations of the Securities and Exchange Commission. In order to effectuate

the covenants of this subparagraph 11.1, an appropriate endorsement will be

placed on the certificate of common stock of the purchaser at the time of

distribution of those shares by the seller pursuant to this agreement, and stop

transfer instructions shall be placed with the transfer agent for the

securities.

11.2. Evidence of Compliance with Private Offering

Exemption.

Seller and shareholders agree to supply purchaser with

evidence of the financial sophistication of the shareholders or evidence of

appointment of a sophisticated investment representative and any other items as

counsel for purchaser may require in order to evidence the private offering

character of the distribution of shares made pursuant to this agreement.

11.3. Notice of Limitation Upon Disposition.

Each shareholder is aware that the shares distributed

will not have been registered pursuant to the Securities Act of 1933, as

amended; and, therefore, under current interpretations and applicable rules, he

or she will probably have to retain the shares for a period of at least two

years and at the expiration of the two year period sales may be confined to

brokerage transactions of limited amounts requiring certain notification

filings with the Securities and Exchange Commission and the disposition may be

available only if the purchaser is current in his or her filings with the

Securities and Exchange Commission and the shareholders are aware of Rule 144

issued by the Securities and Exchange Commission under the Securities Act of

1933, as amended, and the other limitations imposed on their disposition of

purchaser's shares.

11.4. Registration Rights on Form S-16.

If any shareholder shall so request in writing within

a period of two years beginning with the closing date, purchaser will, after

request, proceed at its own expense to prepare and to file with the Securities

and Exchange Commission ("SEC") as soon as reasonably practicable

after receipt of the request one registration statement upon Form S-16 under

the Securities Act of 1933, as amended, with respect to all or part (as so

requested) of the shares of common stock of purchaser received by the

shareholder, and will use its best efforts to cause the registration statement

to become effective. Purchaser will, furthermore, at its own expense, use its

best efforts to keep the registration statement current, in accordance with the

rules and regulations of the SEC for the period ending upon a date two years

subsequent to the closing date or 30 days after the effectiveness whichever

occurs later.

11.5. Registration Rights on Other Forms.

In the event that Form S-16 is inappropriate within

the meaning of the Securities Act of 1933, as amended, and/or the rules and

regulations of the SEC, purchaser will, at the request of any shareholder given

in writing between January 31 and May 31 of any year within a period of two

years beginning with the closing date, proceed at its own expense to prepare

and file with the SEC, as soon as reasonably practicable after receipt of the

request, one registration statement upon a form acceptable to the SEC and,

further, undertake to keep the registration statement current and effective for

a period of 30 days from the effective date of the registration.

11.6. Piggyback Rights.

In the event purchaser files a registration statement

under the Securities Act of 1933, as amended, with respect to shares of its

common stock, prior to _________[date], on a form appropriate for

registering shareholders' common stock, purchaser shall give written notice to

shareholders prior to filing, and shareholders shall have the right to request

to have included such shares of purchaser's common stock as shall be specified

in the request, provided, however, that the inclusion of the shares shall not

interfere with purchaser's registration of its shares and that in no event

shall purchaser be obligated (i) to file a registration statement at any time

other than during the period ended _________[date], or (ii) to keep the

prospectus with respect to the stock current for more than 30 days after the

effective date of the registration statement; and provided, further, that all

shares sold pursuant to the registration statement are effected within the 30

day period. If shareholders do not make a request for registration within 20

days after receipt of notice from purchaser, purchaser shall have no obligation

to include any shares of purchaser's common stock owned by those shareholders

in the registration statement.

11.7. Payment of Expenses.

In the event of a registration under this paragraph

11, shareholders shall pay and bear the direct selling fees, disbursements and

expenses, including without limitation all underwriters' discounts, commissions

and expenses, but no other cost of registration.

12. Profit Sharing Plan and Other Employee Benefit

Plans.

Purchaser and seller shall before and after the

closing take all actions which may be necessary, convenient or appropriate in

the opinion of purchaser to transfer to purchaser all the rights and to cause

purchaser to assume all the liabilities of seller under its profit sharing plan

and trust (including the adoption of amendments to the plan and trust and

action as may be necessary to secure approvals of the Internal Revenue Service

which may be required or deemed advisable), to the end that the plan may be

integrated into seller's profit sharing plan treating employment with seller as

employment with purchaser under its plans and preserving the benefits

previously accrued to seller's employees. All other employee benefit plans

including but not limited to health and accident insurance, major medical

insurance, sick pay plans, noninsured maternity benefits, group life insurance,

and other employee fringe benefits shall be continued by purchaser subject to

the same rights of termination available to seller.

13. Closing.

13.1. Time and Place.

The closing of this transaction ("closing")

shall take place at the offices of _________ in _________, _________, at —.m., _________[date],

or at any other time and place as the parties shall agree upon. This date is

referred to in this agreement as the "closing date."

13.2. Documents To Be Delivered by Seller.

At the closing seller shall deliver to purchaser the

following documents:

(a). Deeds of real estate and bills of sale and such

other instruments of assignment, transfer, conveyance or endorsement as will be

sufficient in the opinion of purchaser and its counsel to transfer to purchaser

full, complete and absolute title to all assets of the seller to be

transferred.

(b). Title insurance policies in the amount of $_____

covering seller's real estate.

(c). A certificate signed by the officers of seller

that the representations and warranties made by seller in this agreement are

substantially accurate in all material respects on and as of the closing date

with the same effect as though the representations and warranties had been made

on or given on and as of the closing date and that seller has performed and

complied with all its obligations under this agreement which are to be

performed or complied with by or prior to or on the closing date.

(d). A written opinion from counsel for seller dated

as of the closing date addressed to the purchaser satisfactory in form and

substance to purchaser to the effect that:

(1) The corporate existence and good standing and

qualification of seller and its subsidiaries is as stated in subparagraph 2.1;

(2) The ownership of common stock of subsidiaries is

as stated in subparagraph 2.1;

(3) This agreement has been duly executed and

delivered by seller and constitutes a legal, valid and binding obligation of

seller enforceable in accordance with its terms;

(4) Counsel has no knowledge of any of the proceedings

stated in subparagraph 2.4(e);

(5) To the best of counsel's knowledge seller is in

compliance with all statutes, regulations, rules and executive orders of all

government authorities as stated in subparagraph 2.4(d); and

(6) To the best of counsel's knowledge seller's

representations and warranties in subparagraphs 2.4(h) and 2.4(l) are true and

correct.

(e). Employment agreements between _________,

_________, and _________ and purchaser in satisfactory form to purchaser.

(f). A certified copy of the duly adopted resolutions

of shareholders and board of directors authorizing the transactions

contemplated by this agreement.

(g). A copy of the bylaws of seller certified by its

secretary and a copy of the certificate of incorporation of seller certified by

the secretary of state.

(h). Incumbency certificate relating to all parties

executing documents relating to any of the transactions contemplated.

(i). Certificates or letters from shareholders

evidencing the taking of the shares in accordance with the provisions of

paragraph 11 and their understanding of the restrictions.

(j). General release in form and substance

satisfactory to purchaser and its counsel of all claims that any officer or

director of seller may have to the date of closing against seller, purchaser

and/or the directors, officers, agents and employees of seller except as may be

described in written contracts expressly described and excepted from the

releases.

(k). Any other documents of transfer, certificates of

authority and other documents as purchaser may reasonably request.

13.3. Documents To Be Delivered by Purchaser.

At the closing purchaser shall deliver to seller the

following documents:

(a). Certificates for the number of shares of

purchaser's common stock as determined in subparagraph 1.4. These shares are to

be registered in the name and denominations as seller may specify.

(b). Opinion of counsel for purchaser dated as of the

closing date satisfactory to counsel for seller in form and substance to the

effect that:

(1) Purchaser's corporate existence and good standing

are set forth in subparagraph 4.1;

(2) This agreement has been duly authorized, executed

and delivered by purchaser and is a valid and legally binding obligation of

purchaser enforceable in accordance with its terms;

(3) Purchaser has taken the corporate action as is

necessary to authorize the performance of the obligation imposed upon it by

this agreement.

(c). A certified copy of the duly adopted resolutions

of purchaser's board of directors or executive committee authorizing or

ratifying the execution and performance of this agreement and authorizing or

ratifying the acts of its officers and employees in carrying out the terms and

provisions.

13.4. Other Documents To Be Delivered at the Closing.

The following additional documents shall be delivered:

(a). A letter from _________ accountants dated the

closing date in form and substance satisfactory to purchaser to the effect that

the financial statements of seller and its subsidiaries referred to in

subparagraph 2.2 and covered by the opinions and reports of _________ fairly

present the financial position of seller and its subsidiaries at the dates

mentioned in subparagraph 2.2 and the results of the operation for the years

then ended. These letters shall also state that based upon inquiries of the

officers of seller responsible for financial and accounting matters and other

specified procedures (such procedures not constituting an audit) nothing came

to their attention which in their judgment indicated that during the period

from _________ to a date not earlier than five days prior to the closing date

there was any material adverse change or changes in the financial position of

seller and its subsidiaries or the results of their operations. The letter

shall also state that they have obtained no knowledge of any matter which would

materially increase the liability for federal income taxes provided for the

three (3) fiscal years ended prior to the closing date.

(b). A ruling from the Internal Revenue Service as

provided in subparagraph 7.1.

14. Meeting of Shareholders and Liquidation of Seller.

Seller will duly call, give notice of and hold a

meeting of the holders of its common stock on or before _________[date],

for the purpose of authorizing (i) the conveyance, assignment, transfer and

delivery of the seller's assets to purchaser upon the terms and conditions

provided; (ii) the voluntary dissolution of seller following the distribution

to seller's shareholders of purchaser's common stock and complete liquidation

of seller; and (iii) an amendment to seller's articles of incorporation to

change seller's name at or after the closing date to one which does not include

the name of _________ or any variant. Seller shall be dissolved as promptly as

practical after the closing and after seller, in complete winding up and

liquidation of seller, distributes to the holders of seller's common stock, in

exchange for and upon surrender for cancellation of their certificates, shares

of purchaser's common stock to be delivered to seller pursuant to paragraph 1.

Purchaser shall not be obligated to issue fractional shares of common stock of

purchaser in connection with distribution of shares by seller to shareholders.

Instead seller shall make appropriate arrangements satisfactory to purchaser

for the purchase or sale, for the account of shareholders entitled to

fractional interests, of their fractional interests in common stock of purchaser.

15. Law Governing.

This agreement may not be modified or terminated

orally, and shall be construed and interpreted according to the laws of the

State of _________.

16. Assignment.

This agreement shall not be assigned by any party

without the written consent of the others.

17. Amendment and Modification.

Purchaser and seller may amend, modify and supplement

this agreement in any manner as may be agreed upon by them in writing.

18. Termination and Abandonment.

This agreement may be terminated and the transaction

provided for by this agreement may be abandoned without liability on the part

of any party to any other, at any time before the closing date:

(a) By mutual consent of purchaser and seller;

(b) By purchaser:

(1) If any of the conditions provided for in paragraph

6 of this agreement have not been met and have not been waived in writing by

purchaser;

(c) By seller:

(1) If any of the conditions provided for in paragraph

7 of this agreement have not been met and have not been waived in writing by

seller.

In the event of termination and

abandonment by any party as provided above in this paragraph 18, written notice

shall be given to the other party, and each party shall pay its own expenses

incident to preparation for the consummation of this agreement and the

transactions contemplated.

19. Notices.

All notices, requests, demands and other

communications shall be deemed to have been duly given, if delivered by hand or

mailed, certified or registered mail with postage prepaid:

(a) If to seller to _________ at _________[address],

or to any other person and place as seller shall furnish to purchaser in

writing; or

(b) If to purchaser, to _________ at _________[address],

or to any other person and place as purchaser shall furnish to seller in

writing.

20. Announcements.

Announcements concerning the transactions provided for

in this agreement by either seller or purchaser shall be subject to the

approval of the other in all essential respects, except that seller's approval

of form shall not be required as to any statements and other information which

purchaser may submit to the Securities and Exchange Commission, the New York

Stock Exchange or purchaser's shareholders or be required to make pursuant to

any rule or regulation of the Securities and Exchange Commission or New York

Stock Exchange.

21. Entire Agreement.

This instrument embodies the entire agreement between

the parties with respect to the transactions contemplated, and there have been

and are no agreements, representations or warranties between the parties other

than those set forth or provided for.

22. Counterparts.

This agreement may be executed simultaneously in two

or more counterparts, each of which shall be deemed an original, but all of

which together shall constitute one and the same instrument.

23. Headings.

The headings in the paragraphs of this agreement are

inserted for convenience only and shall not constitute a part.

24. Further Documents.

Purchaser and seller agree to execute any and all

other documents and to take any other action or corporate proceedings as may be

necessary or desirable to carry out the terms.

In witness of, the parties have caused this agreement

to be duly executed all as of the day and year first written above.

[Corporate seal]

_________

Attest _________, Secretary

By _________, President

[Corporate seal]

_________

Attest _________, Secretary

By _________, President

Shareholders

_________

_________

_________

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

Keywords: C- corp, reorganization

|

|

|