|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

Primary area of practice |

please specify field of law here:

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

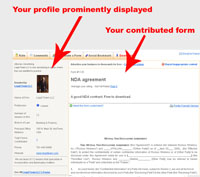

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

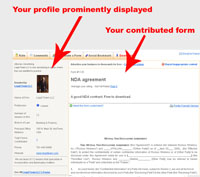

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

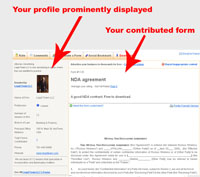

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

|

Advertise your business to thousands for free –

Contribute a form

|

|

Form #693Term Loan Agreement

|

Average user rating: |

Not Yet Rated

|

Rate it |

|

Term Loan Agreement - Free Legal Form

|

Need this form customized?

Need this form customized? |

Download This Form

Download This Form

|

Printer Friendly Version

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your

agreement to hold this site, its officers, employees and any contributors to this

site harmless for any damage you might incur from your use of any submissions contained

on this site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice. YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

|

Term loan.

Term

Loan Agreement

Dated as

of _________

[Salutation]

_________, a _________ corporation with its principal

offices located at city of _________, state of _________("Company"),

requests that _________("Bank") make a term loan in the

principal amount of $_____ to the Company on the terms and conditions set forth

below.

Article I.

Definitions and Interpretation

1.01. Definitions. As used in this Agreement, the

following terms have the following respective meanings:

"Affiliate" shall mean a person, firm or

corporation which, directly, or indirectly through one or more intermediaries,

controls or is controlled by, or is under common control with, the Company.

"Agreement" or "Loan Agreement"

means this Term Loan Agreement, as it may from time to time be amended,

supplemented or otherwise modified.

"Business Day" means a day which is not a

Saturday, Sunday or other day on which commercial banking institutions in

_________ city, _________ state, are permitted or required by law to remain

closed.

"Capitalized Lease" means any lease which is

capitalized on the books of the lessee, or should be so capitalized under

generally accepted accounting principles.

"Controlled Group" means a controlled group

of corporations as defined in Section 1563 of the Internal Revenue Code of

1986, as amended, of which the Company is a part.

"Current Ratio" means the relationship,

expressed as a numerical ratio, between:

(a). the amount of all assets which under generally

accepted principles of accounting would appear as current assets on the balance

sheet of the Company, excluding prepaid expenses which are not refundable on

the date the determination is made, and

(b). the amount of all liabilities which under

generally accepted principles of accounting would appear as current liabilities

on such balance sheet, including all indebtedness payable on demand or maturing

(whether by reason of specified maturity, fixed prepayments, sinking funds or

accruals of any kind, or otherwise) within 12 months or less from the date of

the relevant statement, including all lease and rental obligations due in 12

months or less under leases, whether or not Capitalized Leases, and including

customers' advances and progress billings on contracts.

"Debt to Worth Ratio" means the

relationship, expressed as a numerical ratio, between:

(a). the total of all liabilities of the Company which

would appear on a balance sheet of the Company in accordance with generally

accepted principles of accounting, including capitalized lease obligations, and

(b). Tangible Net Worth.

"Default" means any Event of Default or any

event or condition that with the giving of notice or lapse of time, or both,

would constitute an Event of Default.

"ERISA" means the Employee Retirement Income

Security Act of 1974, as amended from time to time.

"Environmental Audit" means a review for the

purpose of determining whether the Company complies with Environmental Laws and

whether there exists any condition or circumstance which requires or will

require a cleanup, removal, or other remedial action under Environmental Laws

on the part of the Company including, but not limited to, some or all of the

following:

(a) on site inspection including review of site

geology, hydrogeology, demography, land use and population;

(b) taking and analyzing soil borings and installing

ground water monitoring wells and analyzing samples taken from such wells;

(c) taking and analyzing of air samples and testing of

underground tanks;

(d) reviewing plant permits, compliance records and

regulatory correspondence, and interviewing enforcement staff at regulatory

agencies;

(e) reviewing the Company's operations, procedures and

documentation; and

(f) interviewing past and present employees of the

Company.

"Environmental Laws" means all federal,

state and local laws including statutes, regulations, ordinances, codes, rules

and other governmental restrictions and requirements relating to the discharge

of air pollutants, water pollutants or process waste water or otherwise

relating to the environment or hazardous substances including, but not limited

to, the Federal Solid Waste Disposal Act, the Federal Clean Air Act, the

Federal Clean Water Act, the Federal Resource Conservation and Recovery Act of

1976, the Federal Comprehensive Environmental Responsibility Cleanup and

Liability Act of 1980, regulations of the Environmental Protection Agency,

regulations of the Nuclear Regulatory Agency, and regulations of any state

department of natural resources or state environmental protection agency now or

at any time hereafter in effect.

"Event of Default" means any one of the

events described in Section 7.01.

"Indebtedness" means, collectively, all

obligations, contingent and otherwise, which, in accordance with generally

accepted accounting principles, should be classified on the balance sheet of

the Company as liabilities, and, in any event, including, whether or not

classified on such balance sheet, all (i) obligations for borrowed money or for

the deferred purchase price of property; (ii) obligations upon which interest

charges are customarily paid; (iii) obligations secured by any Lien on or with

respect to any property or assets owned by the Company or acquired by the

Company, whether or not the obligation secured thereby shall have been assumed;

(iv) guaranties, endorsements and other contingent obligations; (v)

reimbursement on indemnity undertakings with respect to letters of credit; and

(vi) obligations as lessee under capitalized leases.

"Lien" means any mortgage, pledge,

assignment, hypothecation, security interest, charge or other encumbrance of

any kind or nature whatsoever of or on any cash, property or assets of any kind

or nature whatsoever.

"Net Earnings" means the excess of:

(a). all revenues and income derived from operation in

the ordinary course of business (excluding extraordinary gains and profits upon

the disposition of investments and fixed assets), over

(b). all expenses and other proper charges against

income (including payment or provision for all applicable income and other

taxes, but excluding extraordinary losses and losses upon the disposition of

investments and fixed assets), all as determined in accordance with generally

accepted accounting principles.

"Net Working Capital" means:

(a). the amount of all assets which under generally

accepted principles of accounting would appear as current assets on the balance

sheet of the Company, excluding prepaid expenses which are not refundable on

the date the determination is made, less

(b). the amount of all liabilities which under

generally accepted principles of accounting would appear as current liabilities

on such balance sheet, including all indebtedness payable on demand or maturing

(whether by reason of specified maturity, fixed prepayments, sinking funds or

accruals of any kind, or otherwise) within 12 months or less from the date of

the relevant statement, including all lease and rental obligations due in 12

months or less under leases, whether or not Capitalized Leases, and including

customers' advances and progress billings on contracts.

"Obligations" means any and all liabilities,

obligations and undertakings of the Company to the Bank arising under this

agreement or the Note.

"Permitted Liens" means:

(a) liens outstanding on _________, and shown on the

financial statements referred to in section 4.05 above;

(b) liens for taxes, assessments or governmental

charges, and liens incident to construction, which are either not delinquent or

are being contested in good faith by the Company by appropriate proceedings

which will prevent foreclosure of such liens, and against which adequate

reserves have been provided; and easements, restrictions, minor title

irregularities and similar matters which have no adverse effect as a practical

matter upon the ownership and use of the affected property by the Company;

(c) liens or deposits in connection with worker's

compensation or other insurance or to secure customs' duties, public or

statutory obligations in lieu of surety, stay or appeal bonds, or to secure

performance of contracts or bids (other than contracts for the payment of money

borrowed), or deposits required by law or governmental regulations or by any

court order, decree, judgment or rule as a condition to the transaction of

business or the exercise of any right, privilege or license; or other liens or

deposits of a like nature made in the ordinary course of business;

(d) purchase money liens on property acquired in the

ordinary course of business, to finance or secure a portion of the purchase

price thereof, and liens on property acquired existing at the time of

acquisition; provided that in each case such lien shall be limited to the

property so acquired and the liability secured by such lien does not exceed

either the purchase price or the fair market value of the asset acquired; and

(e) liens required by this agreement as security for

the Note.

"Plan" means any employee pension benefit

plan subject to Title IV of ERISA maintained by the Company or any member of

the Controlled Group, or any such plan to which the Company or any member of

the Controlled Group is required to contribute on behalf of any of its

employees.

"Reportable Event" means a reportable event

as that term is defined in Title IV of ERISA.

"Tangible Net Worth" means the total of all

assets properly appearing on the balance sheet of the Company in accordance

with generally accepted accounting principles, less the sum of the following:

(a) the book amount of all such assets which would be

treated as intangibles under generally accepted accounting principles,

including, without limitation, all such items as good will, trademarks,

trademark rights, trade names, trade-name rights, brands, copyrights, patents,

patent rights, licenses, deferred charges and unamortized debt discount and

expense;

(b) any write-up in the book value of any such assets

resulting from a revaluation thereof subsequent to _________;

(c) all reserves, including reserves for depreciation,

obsolescence, depletion, insurance, and inventory valuation, but excluding

contingency reserves not allocated for any particular purpose and not deducted

from assets;

(d) the amount, if any, at which any shares of stock

of the Company appear on the asset side of such balance sheet;

(e) all liabilities of the Company shown on such

balance sheet, other than liabilities subordinated to obligations owed to the

Bank by subordination agreements in form and substance satisfactory to the

Bank; and

(f) all investments in foreign affiliates and

nonconsolidated domestic affiliates.

"Unfunded Liabilities" means, with regard to

any Plan, the excess of the current value of the Plan's benefits guaranteed

under ERISA over the current value of the Plan's assets allocable to such

benefits.

Article II.

Loan and Note

2.01. Term Loan. At any time on or prior to _________,

the Company may obtain a term loan from the Bank in the amount of up to $_____

which shall be evidenced by a single promissory note ("Note") payable

to the order of the Bank in the principal amount advanced, dated as of the date

that such loan is made to the Company, in the form of Exhibit A attached here.

The Note shall be executed by the Company and delivered to the Bank prior to or

simultaneously with the making of such loan.

The Loan is for a fixed term of _________ years. The

interest rate on the loan will be fixed at _________. The note is payable in

_________ equal consecutive installments of $_____. The first payment will be

due on or before _________.

2.02. Use of Proceeds. The Company represents,

warrants and agrees that:

(a). The proceeds of the loan made under this

agreement will be used solely for the following purposes: (i) contemporaneously

with the making of such loan, the proceeds of such loan shall be used to the

extent necessary to pay all indebtedness of the Company outstanding under

_________ and (ii) all other proceeds shall be used _________.

(b). No part of the proceeds of the loan made under

this agreement will be used to "purchase" or "carry" any

"margin stock" or to extend credit to others for the purpose of

"purchasing" or "carrying" any "margin stock" (as

such terms are defined in the Regulation U of the Board of Governors of the

Federal Reserve System), and the assets of the Company do not include, nor does

the Company have any present intention of acquiring, any such security.

2.03. Balance Deficiency Fee. The Company shall pay to

the Bank promptly upon receipt of the Bank's statement a balance deficiency fee

for each quarter-annual period ending on the last days of _________ of each

year, equal to _____% per year on the excess, if any, of (a) an amount equal to

_____% of the average daily unpaid principal balance of the Note for that

quarter; over (b) the average daily collected balance in noninterest bearing

accounts maintained by the Company with the Bank during such quarter and not

required to support account activity and other credit available from the Bank.

2.04. Prepayment.

(a). Optional. The Note may be pre-paid in whole or in

part at the option of the Company on any interest payment date without premium

or penalty; provided, however, that if the funds for all or part of any

prepayment are obtained or made available, directly or indirectly, through

borrowings made by the Company, the Company shall pay a premium equal to _____%

of the amount of the prepayment for each year or part thereof of the unexpired

term or terms of the principal installment or installments being prepaid. In

case of prepayment of less than all of the outstanding principal amount of the

Note, such prepayment shall be in multiples of $_____ and shall be applied upon

the principal installments of the Note in the inverse order of their

maturities. All prepayments shall be accompanied by interest accrued on the

amount prepaid through the date of prepayment.

(b). Mandatory. If _________ shall cease for any

reason to be active in the management of the Company for a period of _________

consecutive days or more, or shall cease to own at least _____% of the total

outstanding capital stock of the Company, and is not replaced by an individual

of comparable ability and experience, then the Company shall promptly give the

Bank written notice thereof, and (i) the Bank may immediately terminate its

obligation to make a loan under this agreement, and (ii) upon the written

demand of the Bank, the Company will pay the then unpaid principal amount of

the Note, together with accrued interest on it, on the date specified in such

demand, which shall not be less than _________ after such demand.

2.05.

Computations; Nonbusiness Days. All fees, and all interest payable on the Note,

shall be computed for the actual number of days elapsed, using a daily rate

determined by dividing the annual rate by 360. Whenever any payment to be made

under this agreement or under the Note shall be stated to be due on a Saturday,

Sunday or a

public holiday under the laws of the State of

_________, such payment may be made on the next succeeding business day, and

such extension of time shall be included in the computation of interest under

the Note.

2.06. Deposits; Set Off. The Company grants the Bank,

as security for the Note, a lien and security interest in any and all monies,

balances, accounts and deposits (including certificates of deposit) of the

undersigned at such Bank now or at any time after the date of this agreement.

If any Event of Default occurs under this agreement or any attachment of any

balance of the Company occurs, the Bank may offset and apply any such security

toward the payment of the Note, whether or not the Note, or any part of it,

shall then be due. Promptly upon its charging any account of the Company

pursuant to this section, the Bank shall give the Company notice thereof.

Article III.

Conditions of Borrowing

Without limiting any of the other terms of this

agreement, the Bank shall not be required to make the loan to the Company under

this agreement.

3.01. Representations. Unless the representations and

warranties contained in Article IV continue to be true and correct on the date

of such loan; no Event of Default under this agreement shall have occurred and

be continuing, and no condition or event shall exist or have occurred which

with the passage of time, the giving of notice or both would constitute an

Event of Default under this agreement; and at least _________ business days

prior to the date of the loan the Bank shall have received a written request

therefor in the form of Exhibit B attached here.

3.02. Guaranty. Unless _________(the

"Guarantor") shall have executed and delivered to the Bank a

guaranty agreement in the form attached here as Exhibit C

("Guaranty").

3.03. Subordination. Unless _________ shall have

executed and delivered to the Bank a subordination agreement in the form

attached hereto as Exhibit D (the "Subordination Agreement").

3.04. Security Agreement. Unless the Company shall

have executed and delivered to the Bank a security agreement in the form

attached here as Exhibit E ("Security Agreement") and financing

statements, in form satisfactory to the Bank, covering the collateral described

in the Security Agreement.

3.05. Collateral Pledge Agreement. Unless _________

shall have executed and delivered to the Bank a collateral pledge agreement in

the form of Exhibit F attached here ("Collateral Pledge Agreement");

stock certificates representing _________, as collateral; and appropriate stock

powers executed in blank.

3.06. Mortgage. Unless the Company shall have executed

and delivered to the Bank a mortgage in the form attached here as Exhibit G

("Mortgage").

3.07. Assignment of Life Insurance. Unless the benefits

payable on the death of _________ under a life insurance policy in the face

amount of not less than $_____ shall have been assigned to the Bank by

instruments of assignment in form and substance satisfactory to the Bank, and

unless such life insurance policy shall be in full force and effect on the date

of the loan.

3.08. Filings. Unless any documents (including,

without limitation, financing statements) required to be filed, registered or

recorded in order to create, in favor of the Bank, perfected security interests

in the collateral in the jurisdictions listed on Schedule 1 to the Security

Agreement shall have been properly filed, registered or recorded in each office

in each such jurisdiction which such filings, registrations and recordations

are required; the Bank shall have received acknowledgement copies of all such

filings, registrations and recordations stamped by the appropriate filing,

registration or recording officer (or, in lieu thereof, other evidence

satisfactory to the Bank that all such filings, registrations and recordations

have been made); and the Bank shall have received such evidence as it may deem

satisfactory that all necessary filing, recording and other similar fees, and

all taxes and other expenses related to such filings, registrations and

recordings have been paid in full.

3.09. Priority. Unless the Bank shall have received,

in form and substance satisfactory to the Bank, such lien searches, title

insurance policies and other evidence of lien priority covering the mortgages

and security interest granted to the Bank under this agreement as the Bank may

require.

3.10. Insurance Certificate. Unless the Bank shall

have received evidence satisfactory to it that the Company maintains hazard and

liability insurance coverage reasonably satisfactory to the Bank.

3.11. Form U-1. Unless the Company shall have executed

and delivered to the Bank a Federal Reserve Form U-1 provided for in Regulation

U of the Board of Governors of the Federal Reserve System, and the statements

made in it shall be such, in the opinion of the Bank, as to permit the

transactions contemplated by this agreement without violation of Regulation U.

3.12. Counsel Opinion. Unless the Bank shall have

received from its counsel and from Company's counsel, satisfactory opinions as

to such matters relating to the Company, the validity and enforceability of

this agreement, the loan to be made under this agreement and the other

documents required by this Article as the Bank shall reasonably require. The

Company shall execute and/or deliver to the Bank or its counsel such documents

concerning its corporate status and the authorization of such transactions as

may be requested.

3.13. Proceedings Satisfactory. Unless all proceedings

taken in connection with the transactions contemplated by this agreement, and

all instruments, authorizations and other documents applicable to it, shall be

satisfactory in form and substance to the Bank and its counsel.

3.14. Environmental Questionnaire. Unless at least

_________ business days before the loan is made, the Bank shall have received a

written response to its inquiries of the Company concerning compliance by the

Company with Environmental Laws, and such written response shall be certified

by a responsible officer of the Company to be true and correct to the best of

his or her knowledge and belief, after due inquiry, and shall be in form and

substance satisfactory to the Bank.

3.15. Environmental Audit. Unless the Company permits,

at its expense, at the request of the Bank, an Environmental Audit solely for

the benefit of the Bank, to be conducted by the Bank or an independent agent

selected by the Bank and which may not be relied upon by the Company for any

purpose. This provision shall not relieve the Company from conducting its own

Environmental Audits or taking any other steps necessary to comply with

Environmental Laws.

3.16. Violation of Environmental Laws. If in the

opinion of the Bank there exists any uncorrected violation by the Company of an

Environmental Law or any condition which requires, or may require, a cleanup,

removal or other remedial action by the Company under any Environmental Laws.

Article IV.

Representations and Warranties

In order to induce the Bank to make the loan as

provided here, the Company represents and warrants to the Bank as follows:

4.01. Organization and Power. The Company is a

corporation organized and existing in good standing under the laws of the state

of _________, and has all requisite power, authority and legal right corporate

or otherwise, to conduct its business and to own its properties. The Company

has no subsidiary. The Company is licensed or qualified to do business in all

jurisdictions in which such qualification is required, and failure to so

qualify could have a material adverse effect on the property, financial

condition or business operations of the Company.

4.02.

Authority. The execution, delivery and performance of this agreement, the Note

and the documents required by Article III ("Collateral Documents")

are within the corporate powers of the Company, have been authorized by all

necessary corporate action and do not and will not (a) require any consent or

approval of the

stockholders of the Company; (b) violate any provision

of the articles of incorporation or bylaws of the Company or of any law, rule,

regulation, order, writ, judgment, injunction, decree, determination or award

presently in effect having applicability to the Company; (c) require the

consent or approval of, or filing or registration with, any governmental body,

agency or authority; or (d) result in a breach of or constitute a default

under, or result in the imposition of any lien, charge or encumbrance upon any

property of the Company pursuant to, any indenture or other agreement or

instrument under which the Company is a party or by which it or its properties

may be bound or affected. This agreement constitutes, and the Note and each of

the documents required by Article III when executed and delivered under this

agreement will constitute, legal, valid and binding obligations of the Company

or other signatory enforceable in accordance with its terms, except as such

enforceability may be limited by bankruptcy or similar laws affecting the

enforceability of creditors' rights generally.

4.03. Investment Company Act of 1940. The Company is

not an "investment company" or a company "controlled" by an

"investment company" within the meaning of the Investment Company Act

of 1940, as amended.

4.04. Employee Retirement Income Security Act. All

Plans are in compliance in all material respects with the applicable provisions

of ERISA. The Company has not incurred any material "accumulated funding

deficiency" within the meaning of section 302(a)(2) of ERISA in connection

with any Plan. There has been no Reportable Event for any Plan, the occurrence

of which would have a materially adverse effect on the Company, nor has the

Company incurred any material liability to the Pension Benefit Guaranty Corporation

under section 4062 of ERISA in connection with any Plan. The Unfunded

Liabilities of all Plans do not in the aggregate exceed $_____.

4.05. Financial Statements. The balance sheet of the

Company as of _________, and the statement of profit and loss and surplus of

the Company for the year ended on that date, as prepared by _________ and

previously furnished to the Bank, are correct and complete and truly represent

the financial condition of the Company as of _________, and the results of its

operations for the fiscal year ended on that date. Since such date there has

been no material adverse change in the property, financial condition or

business operations of the Company. The Company does not have any material

contingent obligations, liabilities for taxes, long-term leases, or unusual

forward or long-term commitments which are not reflected in its financial

statements.

4.06. Dividends and Redemptions. The Company has not,

since _________, paid or declared any dividend, or made any other distribution

on account of any shares of any class of its stock, or redeemed, purchased or

otherwise acquired, directly or indirectly, any shares of any class of its

stock. The Company is not a party to any agreement which may require it to

redeem, purchase or otherwise acquire any shares of any class of its stock.

4.07. Liens. The Company has good and clear record and

marketable title to all of its assets, real and personal, free and clear of all

liens, security interests, mortgages and encumbrances of any kind, except Permitted

Liens. All owned and leased buildings and equipment of the Company are in good

condition, repair and working order in all material respects and, to the best

of the Company's knowledge and belief, conform in all material respects to all

applicable laws, regulations and ordinances.

4.08. Contingent Liabilities. The Company does not

have any guarantees or other contingent liabilities outstanding (including,

without limitation, liabilities by way of agreement, contingent or otherwise,

to purchase, to provide funds for payment, to supply funds to or otherwise

invest in the debtor or otherwise to assure the creditor against loss), except

those permitted by section 5.09.

4.09. Taxes. Except as expressly disclosed in the

financial statements referred to in section 4.05 above, the Company does not

have any material outstanding unpaid tax liability (except for taxes which are

currently accruing from current operations and ownership of property, which are

not delinquent), and no tax deficiencies have been proposed or assessed against

the Company. The most recent completed audit of the Company's federal income

tax returns was for the Company's income tax year ending _________, and all

taxes shown by such returns (together with any adjustments arising out of such audit,

if any) have been paid.

4.10. Absence of Litigation. The Company is not a

party to any litigation or administrative proceeding, nor so far as is known by

the Company is any litigation or administrative proceeding threatened against

it, which in either case (a) relates to the execution, delivery or performance

of this agreement, the Note, or any of the Collateral Documents, (b) could, if

adversely determined, cause any material adverse change in its property,

financial condition or the conduct of its business, (c) asserts or alleges that

the Company violated Environmental Laws, (d) asserts or alleges that the

Company is required to cleanup, remove, or take remedial or other response

action due to the disposal, depositing, discharge, leaking or other release of

any hazardous substances or materials, or (e) asserts or alleges that the

Company is required to pay all or a portion of the cost of any past, present or

future cleanup, removal or remedial or other response action which arises out

of or is related to the disposal, depositing, discharge, leaking or other

release of any hazardous substances or materials by the Company.

4.11. Absence of Default. No event has occurred which

either of itself or with the lapse of time or the giving of notice or both, would

give any creditor of the Company the right to accelerate the maturity of any

indebtedness of the Company for borrowed money. The Company is not in default

under any other lease, agreement or instrument, or any law, rule, regulation,

order, writ, injunction, decree, determination or award, noncompliance with

which could materially adversely affect its property, financial condition or

business operations.

4.12. No Burdensome Agreements. The Company is not a

party to any agreement, instrument indenture, lease (except those permitted by

Section 5.10) or undertaking, or subject to any other restriction, (a) which

materially adversely affects or may in the future so affect the property,

financial condition or business operations of the Company, or (b) under or

pursuant to which the Company is or will be required to place (or under which

any other person may place) a lien upon any of its properties securing

indebtedness either upon demand or upon the happening of a condition, with or

without such demand.

4.13. Trademarks, etc. The Company possesses adequate

trademarks, trade names, copyrights, patents, permits, service marks and

licenses, or rights thereto, for the present and planned future conduct of

their respective businesses substantially as now conducted, without any known

conflict with the rights of others which might result in a material adverse

effect on the Company.

4.14. Partnerships; Joint Ventures. The Company is not

a member of any partnership or joint venture.

4.15. Full Disclosure. No information, exhibit or

report furnished by the Company to the Bank in connection with the negotiation

or execution of this agreement contained any material misstatement of fact as

of the date when made or omitted to state a material fact or any fact necessary

to make the statements contained in it not misleading as of the date when made.

4.16. Location of Records. The Company is located at

the address _________. The only place where the Company keeps current financial

and other records is at such address.

4.17. Fiscal Year. The fiscal year of the Company ends

on _________ of each year.

4.18. Dump Sites. With respect to the period during

which the Company owned or occupied its real estate, and to the Company's

knowledge after reasonable investigation, with respect to the time before the

Company owned or occupied its real estate, no person or entity has caused or

permitted materials to be stored, deposited, treated, recycled or disposed of

on, under or at any real estate owned or occupied by the Company, which

materials, if known to be present, would require cleanup, removal or some other

remedial action under Environmental Laws.

4.19. Tanks. There are not now, nor to the Company's

knowledge after reasonable investigation have there ever been, tanks or other

facilities on, under, or at any real estate owned or occupied by the Company

which contained materials which, if known to be present in soils or ground

water, would require cleanup, removal or some other remedial action under

Environmental Laws.

4.20. Other Environmental Conditions. To the Company's

knowledge after reasonable investigation, there are no conditions existing

currently or likely to exist during the term of the Note which would subject

the Company to damages, penalties, injunctive relief or cleanup costs under any

Environmental Laws or which require or are likely to require cleanup, removal,

remedial action or other response pursuant to Environmental Laws by the

Company.

4.21. Changes in Laws. To the Company's knowledge

after reasonable investigation, there are no proposed or pending changes in

Environmental Laws that would adversely affect the Company.

4.22. Environmental Judgments, Decrees and Orders. The

Company is not subject to any judgment, decree, order or citation related to or

arising out of Environmental Laws and has not been named or listed as a

potentially responsible party by any governmental body or agency in a matter

arising under any Environmental Laws.

4.23. Environmental Permits and Licenses. The Company

has all permits, licenses and approvals required under Environmental Laws, all

of which are listed on Schedule 3 and attached to this agreement.

Article V.

Negative Covenants

While the credit granted to the Company is available

and while any part of the principal of or interest on the Note remains unpaid,

the Company shall not do any of the following, without the prior written

consent of the Bank:

5.01. Restriction of Indebtedness. Create, incur,

assume or have outstanding any indebtedness for borrowed money or the deferred

purchase price of any asset (including obligations under Capitalized Leases),

except:

(a) the Note issued under this agreement;

(b) indebtedness for current bank borrowings (maturing

in 12 months or less), including renewals available at the option of the

Company which do not exceed $_____ in aggregate principal amount outstanding at

any one time, all of which indebtedness must be completely paid up for a period

of not less than _________ consecutive days in each fiscal year of the Company;

(c) other indebtedness (not including indebtedness for

current bank borrowings) outstanding on _________, and shown on the financial

statements referred to in section 4.05 above, provided that such indebtedness

shall not be renewed, extended or increased; and

(d) indebtedness described in section 1.01, provided

such indebtedness does not exceed an aggregate of $_____ outstanding at any one

time.

5.02. Amendments and Prepayments. Agree to any

amendment, modification or supplement, or obtain any waiver or consent in respect

of compliance with any of the terms of, or call or redeem, or make any purchase

or prepayment of or with respect to, any instrument or agreement evidencing or

relating to any indebtedness for borrowed money or for the deferred purchase

price of any asset, including Capitalized Leases.

5.03. Restriction on Liens. Create or permit to be

created or allow to exist any mortgage, pledge, encumbrance or other lien upon

or security interest in any property or asset now owned or subsequently

acquired by the Company, except Permitted Liens.

5.04. Sale and Leaseback. Enter into any agreement

providing for the leasing by the Company of property which has been or is to be

sold or transferred by the Company to the lessor thereof, or which is

substantially similar in purpose to property so sold or transferred.

5.05. Dividends and Redemptions. Pay or declare any

dividend, or make any other distribution on account of any shares of any class

of its stock, or redeem, purchase or otherwise acquire directly or indirectly,

any shares of any class of its stock, except for:

(a) dividends payable in shares of stock of the

Company;

(b) redemption of stock of the Company made with the

proceeds of sales of stock of the Company occurring within _________ days of

the date of any such redemption; and

(c) cash dividends paid by the Company which do not

exceed in the aggregate for all such dividends paid after _________, _____% of

the Net Earnings of the Company, after subtracting all net losses, accumulated

during the period after _________ and prior to the payment of the dividend with

respect to which the determination is made, taken as a single accounting

period.

5.06. Acquisitions and Investments. Acquire any other

business or make any loan, advance or extension of credit to, or investment in,

any other person, corporation or other entity, including investments acquired

in exchange for stock or other securities or obligations of any nature, or

create or participate in the creation of any subsidiary or joint venture,

except:

(a) investments in (i) bank repurchase agreements;

(ii) savings accounts or certificates of deposit in a financial institution of

recognized standing; (iii) obligations issued or fully guaranteed by the United

States; and (iv) prime commercial paper maturing within _________ days of the

date of acquisition by the Company;

(b) loans and advances made to employees and agents in

the ordinary course of business, such as travel and entertainment advances and

similar items;

(c) credit extended to customers in the ordinary

course of business, provided such credit is due within one year and does not

exceed $_____ outstanding at any one time for any one customer; and

(d) investments outstanding on _________, and shown on

the financial statements referred to in section 4.05 above, provided that such

investments shall not be increased.

5.07. Liquidation; Merger; Disposition of Assets.

Liquidate or dissolve; or merge with or into or consolidate with or into any

other corporation or entity; or sell, lease, transfer or otherwise dispose of

all or any substantial part of its property, assets or business (other than

sales made in the ordinary course of business).

5.08. Accounts Receivable. Discount or sell with

recourse, or sell for less than the face amount thereof, any of its notes or

accounts receivable, whether now owned or subsequently acquired.

5.09. Contingent Liabilities. Guarantee or become a

surety or otherwise contingently liable (including, without limitation, liable

by way of agreement, contingent or otherwise, to purchase, to provide funds for

payment, to supply funds to or otherwise invest in the debtor or otherwise to

assure the creditor against loss) for any obligations of others, except

pursuant to the deposit and collection of checks and similar items in the ordinary

course of business.

5.10. Leases. Incur or permit to be outstanding lease

or rental obligations as lessee of real or personal property, under leases

which are not Capitalized Leases, exceeding in the aggregate for any fiscal

year of the Company _____% of Tangible Net Worth.

5.11. Fixed Asset Expenditure. Expend sums for the

acquisition (including acquisition under Capitalized Leases) of fixed assets in

any one fiscal year of the Company exceeding in the aggregate [$_____] [the Net

Earnings of the Company for such fiscal year, plus either the amount of

depreciation of fixed assets shown on the financial statements of the Company

for such fiscal year, or if less, the amount deductible for depreciation by the

Company for federal income tax purposes for such fiscal year, and minus the

total amount of cash dividends paid or declared by the Company during such

fiscal year].

5.12. Salaries and Other Compensation. Pay salaries,

bonuses, profit-sharing payments or any other compensation of any kind to

officers, directors, and other employees having management or executive

responsibilities exceeding $_____ in the aggregate in any one fiscal year.

5.13. Affiliates. Suffer or permit any transaction

with any Affiliate, except on terms not less favorable to the Company than

would be usual and customary in similar transactions with nonaffiliated

persons.

5.14. Partnerships; Joint Ventures. Become a member of

any partnership or joint venture.

5.15. Fiscal Year. Change its fiscal year.

Article VI.

Affirmative Covenants

While the credit granted to the Company is available

and while any part of the principal of or interest on the Note remains unpaid,

the Company shall unless waived in writing by the Bank:

6.01. Financial Status. At all times maintain:

(a) Net Working Capital in the amount of at least

$_____; and

(b) Current Ratio of at least _________; and

(c) Tangible Net Worth in the amount of at least

$_____; and

(d) Debt to Worth Ratio of not more than _________.

6.02. Insurance. Maintain insurance, with financially

sound and reputable insurance companies, in such amounts and against such risks

as is customary by companies engaged in the same or similar businesses and

similarly situated; and maintain insurance upon the life of _________, its

_________, with the death benefit thereunder in an amount not less than $_____.

The Company shall at all times retain all the incidents of ownership of such

insurance and shall not borrow upon or otherwise impair its right to receive

the proceeds of such insurance. Upon the death of _________, the Bank may

collect the death benefit payable under such insurance and may at its sole

discretion apply the money so collected to the payment of the Note. Should the

death benefit collected by the Bank under this agreement exceed the aggregate

amount necessary to fully satisfy the Company's obligations under this

agreement and the Note, the Bank shall return such excess to the Company after

such obligations are fully satisfied. Upon the request of the Bank, the Company

will provide evidence to the Bank that all premiums in respect of such life

insurance policy have been paid.

6.03. Corporate Existence; Obligations. Do all things

necessary to:

(a) maintain its corporate existence and all rights

and franchises necessary or desirable for the conduct of its business;

(b) comply with all applicable laws, rules,

regulations and ordinances, and all restrictions imposed by governmental

authorities, including those relating to environmental standards and controls;

and

(c) pay, before the same become delinquent and before

penalties accrue thereon, all taxes, assessments and other governmental charges

against it or its property, and all of its other liabilities, except to the

extent and so long as the same are being contested in good faith by appropriate

proceedings in such manner as not to cause any material adverse effect upon its

property, financial condition or business operations, with adequate reserves

provided for such payments.

6.04. Business Activities. Continue to carry on its

business activities in substantially the manner such activities are conducted

on the date of this agreement and not make any material change in the nature of

its business.

6.05. Properties. Keep its properties (whether owned

or leased) in good condition, repair and working order, ordinary wear and tear

and obsolescence excepted, and make or cause to be made from time to time all

necessary repairs thereto (including external or structural repairs) and

renewals and replacements.

6.06. Accounting Records; Reports. Maintain a standard

and modern system for accounting in accordance with generally accepted

principles of accounting consistently applied throughout all accounting periods

and consistent with those applied in the preparation of the financial

statements referred to in section 4.05; and furnish to the Bank such

information respecting the business, assets and financial condition of the

Company as the Bank may reasonably request and, without request, furnish to the

Bank:

(a) Within

_________ days after the end of each of the first three quarters of each fiscal

year of the Company (i) balance sheet of the Company as of the close of such

quarter and of the comparable quarter in the preceding fiscal year; and (ii)

statements of income and surplus of the Company for such quarter and for that

part of the fiscal year

ending with such quarter and for the corresponding

periods of the preceding fiscal year; all in reasonable detail and certified as

true and correct (subject to audit and normal year-end adjustments) by the

chief financial officer of the Company; and

(b) As soon as available, and in any event within

_________ days after the close of each fiscal year of the Company, a copy of

the audit report for such year and accompanying financial statements of the

Company, as prepared by independent public accountants of recognized standing

selected by the Company and satisfactory to the Bank, which audit report shall

be accompanied by an opinion of such accountants, in form satisfactory to the

Bank, to the effect that the same fairly present the financial condition of the

Company and the results of its operations as of the relevant dates thereof;

together with copies of any management letters issued by such accountants in

connection with such audit; and

(c) As soon as available, copies of all reports or

materials submitted or distributed to shareholders of the Company or filed with

the SEC or other governmental agency having regulatory authority over the

Company or with any national securities exchange; and

(d) Promptly after the furnishing thereof, copies of

any statement or report furnished to any other holder of obligations of the

Company pursuant to the terms of any indenture, loan or similar agreement and

not otherwise required to be furnished to the Bank pursuant to any other clause

of this section, and

(e) Within _________ days after the beginning of each

fiscal year of the Company, a schedule showing all insurance policies which the

Company had in force as of the beginning of such fiscal year, signed by a

proper accounting officer of the Company; and

(f) Promptly, and in any event within _________ days,

after Company has knowledge thereof a statement of the chief financial officer

of the Company describing: (i) any event which, either of itself or with the

lapse of time or the giving of notice or both, would constitute a default under

this agreement or under any other material agreement to which the Company is a

party, together with a statement of the actions which the Company proposes to

take with respect thereto; (ii) any pending or threatened litigation or

administrative proceeding of the type described in section 4.10; and (iii) any

fact or circumstance which is materially adverse to the property, financial

condition or business operations of the Company; and

(g) (i) Promptly, and in any event within _________

days, after the Company knows that any Reportable Event with respect to any

Plan has occurred, a statement of the chief financial officer of the Company

setting forth details as to such Reportable Event and the Action which the

Company proposes to take with respect thereto, together with a copy of any

notice of such Reportable Event given to the Pension Benefit Guaranty

Corporation if a copy of such notice is available to the Company, (ii) promptly

after the filing thereof with the Internal Revenue Service, copies of each

annual report with respect to each Plan administered by the Company and (iii)

promptly after receipt thereof, a copy of any notice (other than a notice of general

application) the Company or any member of the Controlled Group may receive from

the Pension Benefit Guaranty Corporation or the Internal Revenue Service with

respect to any Plan administered by the Company.

The financial statements referred to in (a) and (b)

above shall be accompanied by a certificate by the chief financial officer of

the Company that, as of the close of the last period covered in such financial

statements, no condition or event had occurred which constitutes a default

under this agreement or which, after notice or lapse of time or both, would

constitute a default under this agreement (or if there was such a condition or

event, specifying the same). The audit report referred to in (b) above shall be

accompanied by a certificate by the accountants who prepared the audit report,

as of the date of such audit report, stating that in the course of their audit,

nothing has come to their attention suggesting that a condition or event has

occurred which constitutes a default under this agreement or which, after

notice or lapse of time or both, would constitute a default under this

agreement (or if there was such a condition or event, specifying the same); but

such accountants shall not be liable for any failure to obtain knowledge of any

such condition or event.

6.07. Inspection of Records. Permit accountants,

auditors, attorneys and other representatives of the Bank to visit and inspect

any of the properties and examine any of the books and records of the Company

at any reasonable time and as often as may be reasonably desired.

6.08. Compliance with Environmental Laws. Timely

comply with all applicable Environmental Laws.

6.09. Orders, Decrees and Other Documents. Provide to

the Bank, immediately upon receipt, copies of any correspondence, notice, pleading,

citation, indictment, complaint, order, decree, or other document from any

source asserting or alleging a circumstance or condition which requires or may

require a financial contribution by Company or a cleanup, removal, remedial

action, or other response by or on the part of the Company under Environmental

Laws which seeks damages or civil, criminal or punitive penalties from Company

for an alleged violation of Environmental Laws.

6.10. Agreement to Update. Advise the Bank in writing

as soon as Company becomes aware of any condition or circumstance which makes

the environmental warranties contained in this Agreement incomplete or

inaccurate.

6.11. Payment of Taxes. The Company will pay and

discharge all taxes and other assessments and governmental charges imposed on

it or on its income, profits or property prior to the date on which interest,

penalties or liens accrue or attach, and pay and discharge all other known

liabilities and obligations when due, provided that the Company shall not be

required to pay any such tax, assessment, governmental charge or other

liability that is being contested in good faith by appropriate proceedings,

promptly initiated and diligently prosecuted, so long as adequate reserves for

it are maintained and enforcement of any Lien for it is effectively stayed, and

so long as such nonpayment will not have a material adverse effect on the

condition of the Company, financial or otherwise.

Article VII.

Defaults

7.01. Events of Defaults. The occurrence of any one or

more of the following events shall constitute an "Event of Default":

(a) The Company shall fail to pay (i) any interest due

on the Note, or any other amount payable under this agreement (other than a principal

payment on the Note) by _________ days after the same becomes due; or (ii) any

principal amount due on the Note when due;

(b) The Company shall default in the performance or

observance of any agreement, covenant, condition, provision or term contained

in Article V or section 6.01 of this Agreement;

(c) The Company or other signatory other than the Bank

shall default in the performance or observance of any of the other agreements,

covenants, conditions, provisions or terms in this agreement or any Collateral

Document continuing for a period of _________ days after written notice thereof

is given to the Company by the Bank;

(d) Any representation or warranty made by the Company

here or any certificate delivered pursuant to this agreement, or any financial

statement delivered to the Bank under this agreement, shall prove to have been

false in any material respect as of the time when made or given;

(e) The Company shall fail to pay as and when due and

payable (whether at maturity, by acceleration or otherwise) all or any part of

the principal of or interest on any indebtedness of or assumed by it, or of the

rentals due under any lease or sublease, or of any other obligation for the

payment of money, and such default shall not be cured within the period or

periods of grace, if any, specified in the instruments governing such

obligations; or default shall occur under any evidence of, or any indenture,

lease, sublease, agreement or other instrument governing such obligations, and

such default shall continue for a period of time sufficient to permit the

acceleration of the maturity of any such indebtedness or other obligation or

the termination of such lease or sublease;

(f) A final judgment which, together with other

outstanding final judgments against the Company exceeds an aggregate of $_____

shall be entered against the Company and shall remain outstanding and

unsatisfied, unbonded, unstayed or uninsured after _________ days from the date

of entry thereof;

(g) The

Company or any Guarantor shall: (i) become insolvent; or (ii) be unable, or

admit in writing its inability to pay its debts as they mature; or (iii) make a

general assignment for the benefit of creditors or to an agent authorized to

liquidate any substantial amount of its property; or (iv) become the subject of

an "order for relief" within the meaning of the United States

Bankruptcy Code; or (v) become the subject of a creditor's petition for

liquidation, reorganization or to effect a plan or other arrangement with

creditors; or (vi) apply to a court for the appointment of a custodian or

receiver for any of its assets; or (vii) have a custodian or receiver appointed

for any of

its assets (with or without its consent); or (viii)

otherwise become the subject of any insolvency proceedings or propose or enter

into any formal or informal composition or arrangement with its creditors; or

(ix) die;

(h) This Agreement, the Note or any Collateral

Document shall, at any time after their respective execution and delivery, and

for any reason, cease to be in full force and effect or be declared void, or be

revoked or terminated, or the validity or enforceability thereof or hereof

shall be contested by the Company or any shareholder of the Company, or the

Company shall deny that it has any or further liability or obligation

thereunder or under this agreement, as the case may be; or

(i) Any Reportable Event, which the Bank determines in

good faith to constitute grounds for the termination of any Plan by the Pension

Benefit Guaranty Corporation or for the appointment by the appropriate United

States District Court of a trustee to administer any Plan, shall have occurred,

or any Plan shall be terminated within the meaning of Title IV of ERISA, or a

trustee shall be appointed by the appropriate United States District Court to

administer any Plan, or the Pension Benefit Guaranty Corporation shall

institute proceedings to terminate any Plan or to appoint a trustee to

administer any Plan, and in case of any event described in the preceding

provisions of this section the Bank determines in good faith that the aggregate

amount of the Company's liability to the Pension Benefit Guaranty Corporation

under ERISA shall exceed $_____ and such liability is not covered, for the

benefit of the Company, by insurance.

7.02. Termination of Commitment and Acceleration of

Obligations. Upon the occurrence of any Event of Default:

(a) As to any Event of Default (other than an Event of

Default under section 7.01(g)) and at any time thereafter, and in each case,

the Bank may, by written notice to the Company, immediately terminate its

obligation to make a loan under this agreement and/or declare the unpaid

principal balance of the Note, together with all interest accrued thereon, to

be immediately due and payable; and the unpaid principal balance of and accrued

interest on such Note shall immediately be due and payable without further

notice of any kind, all of which are waived, and notwithstanding anything to

the contrary here or contained in the Note;

(b) As to any Event of Default under section 7.01(g),

the obligation of the Bank to make a loan under this agreement shall

immediately terminate and the unpaid principal balance of the Note, together

with all interest accrued, shall immediately be due and payable, all without

presentment, demand, protest, or further notice of any kind, all of which are

waived, notwithstanding anything to the contrary here or contained in the Note;

and

(c) As to each Event of Default, the Bank shall have

all the remedies for default provided by the Collateral Documents, as well as

applicable law.

7.03. Remedies Cumulative. The rights and remedies of

the Bank, not only under this agreement and under the Note, but also under any

other agreement of the Company with the Bank and under applicable law, whether

now or subsequently in force, are cumulative and not exclusive of any other

rights, powers and remedies, and all such rights, powers and remedies may be

exercised singly, alternatively or concurrently.

Article VIII.

Miscellaneous

8.01. Expenses; Indemnity.

(a). The Company shall pay, or reimburse the Bank for:

(i) all reasonable out-of-pocket costs and expenses

(including, without limitation, reasonable attorneys' fees and expenses) paid

or incurred by the Bank in connection with the negotiation, preparation, execution,

delivery, and administration of this agreement, the Note, the Collateral

Documents and any other document required under this agreement or thereunder,

including without limitation any amendment, supplement, modification or waiver

of or to any of the foregoing;

(ii) all reasonable out-of-pocket costs and expenses

(including, without limitation, reasonable attorneys' fees and expenses) paid

or incurred by the Bank before and after judgment in enforcing, protecting or

preserving its rights under this agreement, the Note, the Collateral Documents

and other document required under this agreement or thereunder, including

without limitation the enforcement of rights against, or realization on, any

collateral or security therefor; and

(iii) any and all recording and filing fees and any

and all stamp, excise, intangibles and other taxes, if any, (including, without

limitation, any sales, occupation, excise, gross receipts, franchise, general

corporation, personal property, privilege or license taxes, but not including

taxes levied upon the net income of the Bank by the federal government or the

state of _________), which may be payable or determined to be payable in

connection with the negotiation, preparation, execution, delivery,

administration or enforcement of this agreement, the Note, the Collateral

Documents or any other document required under this agreement or thereunder or

any amendment, supplement, modification or waiver of or to any of the

foregoing, or consummation of any of the transactions contemplated hereby or

thereby, including all costs and expenses incurred in contesting the imposition

of any such tax, and any and all liability with respect to or resulting from

any delay in paying the same, whether such taxes are levied upon the Bank, the

Company or otherwise.

(b). The Company agrees to indemnify the Bank against

any and all losses, claims, damages, liabilities and expenses, (including,

without limitation, reasonable attorneys' fees and expenses) incurred by the

Bank arising out of, in any way connected with, or as a result of

(i) any acquisition or attempted acquisition of stock

or assets of another person or entity by the Company or any subsidiary;

(ii) the use of any of the proceeds of any loans made

under this agreement by the Company or any subsidiary for the making or

furtherance of any such acquisition or attempted acquisition;

(iii) the construction or operation of any facility

owned or operated by the Company or any subsidiary, or resulting from any

pollution or other environmental condition on the site of, or caused by, any

such facility;

(iv) the negotiation, preparation, execution,

delivery, administration, and enforcement of this agreement, the Note, the

Collateral Documents and any other document required under this agreement or

thereunder, including without limitation any amendment, supplement,

modification or waiver of or to any of the foregoing or the consummation or

failure to consummate the transactions contemplated hereby or thereby, or the

performance by the parties of their obligations under this agreement or

thereunder;

(v) any claim, litigation, investigation or

proceedings related to any of the foregoing, whether or not the Bank is a party

thereto; provided, however, that such indemnity shall not apply to any such

losses, claims, damages, liabilities or related expenses arising from:

(A) any unexcused breach by the Bank of its

obligations under this agreement, or

(B) any commitment made by the Bank to a person other

than the Company or any subsidiary which would be breached by the performance

of the Bank's obligations under this agreement.

(c). The foregoing agreements and indemnities shall

remain operative and in full force and effect regardless of termination of this

agreement, the consummation of or failure to consummate either the transactions

contemplated by this agreement or any amendment, supplement, modification or

waiver, the repayment of any loan made under this agreement, the invalidity or

unenforceability of any term or provision of this agreement or the Note or any

Collateral Document, or any other document required under this agreement or

thereunder, any investigation made by or on behalf of the Bank, the Company or

any subsidiary, or the content or accuracy of any representation or warranty

made under this Agreement, any Collateral Document or any other document

required under this agreement or thereunder.

8.02. Securities Act of 1933. The Bank represents that

it is acquiring the Note without any present intention of making a sale or

other distribution of such Note, provided the Bank reserves the right to sell

the Note or participations therein.

8.03. Successors. The provisions of this agreement

shall inure to the benefit of any holder of the Note, and shall inure to the

benefit of and be binding upon any successor to any of the parties here. No

delay on the part of the Bank or any holder of the Note in exercising any

right, power or privilege under this agreement shall operate as a waiver

thereof nor shall any single or partial exercise of any right, power or privilege

under this agreement preclude other or further exercise thereof or the exercise

of any other right, power or privilege. The rights and remedies specified here

are cumulative and are not exclusive of any rights or remedies which the Bank

or the holder of the Note would otherwise have.

8.04. Survival. All agreements, representations and

warranties made here shall survive the execution of this agreement, the making

of the loans under this agreement and the execution and delivery of the Note.

8.05. Governing Law. This agreement and the Note

issued under it shall be governed by and construed in accordance with the

internal laws of the state of _________, except to the extent superseded by

federal law.

8.06. Counterparts. This agreement may be executed in

any number of counterparts, each of which, when so executed and delivered,

shall be deemed to be an original and all of which, when taken together, shall

constitute but one and the same instrument.

8.07. Notices. All communications or notices required

under this agreement shall be deemed to have been given on the date when

deposited in the United States mail, postage prepaid, and addressed as follows